580-619 Credit Score: What It Really Means (And How to Fix It Fast)

What it means for you : A 580-619 Credit Score !

Key Takeaway: A 580-619 credit score is considered “Fair” by FICO® standards. While you’ll qualify for some financial products, you’re paying higher interest rates and missing out on the best deals. The good news? With targeted action, you can reach the “Good” range (620+) in as little as 60-90 days.

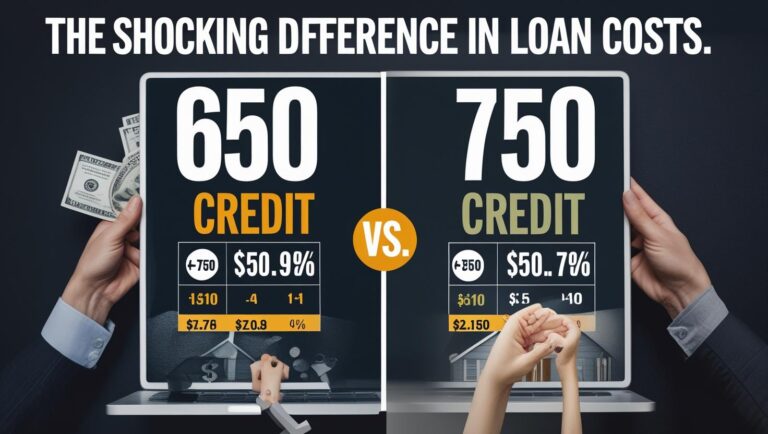

When your score falls between 580-619, lenders view you as a “moderate risk” borrower. Here’s what to expect:

- Auto Loans: Approval likely, but APRs of 12-18% (vs. 5-8% for scores 720+)

- Credit Cards: Mostly secured cards or unsecured cards with annual fees >$100

- Mortgages: Only FHA loans (3.5% down payment required)

- Apartments: May require larger security deposits

| Loan Type | 580-619 Score | 620+ Score |

|---|---|---|

| $25,000 Auto Loan (60 mo) | $550/month (15% APR) | $450/month (8% APR) |

| $300,000 Mortgage (30 yr) | $1,850/month (FHA only) | $1,600/month (Conventional) |

Why Your Score is Stuck Here (The 4 Main Culprits)

Based on credit bureau data, these are the most common reasons for scores in this range:

- High Credit Utilization (50%+): Using more than half your available credit hurts scores significantly

- Late Payments (1-2 in last year): Even one 30-day late can drop scores 80-100 points

- Thin Credit File: Fewer than 3 active accounts makes scoring volatile

- Collections Accounts: Medical bills or forgotten small balances dragging you down

Pro Tip: Check your full credit report to identify which factors are hurting you most.

The 60-Day Fix Plan (Prioritized Steps)

1. Lower Your Credit Utilization Immediately

Pay down balances to below 30% of limits (ideally under 10%). Timing matters – most cards report balances to bureaus on your statement closing date.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →2. Dispute Credit Report Errors

34% of reports contain errors according to FTC data. Dispute these through:

- AnnualCreditReport.com (free weekly reports)

- Credit monitoring services (easier dispute process)

3. Add Positive Credit History

Consider:

- Secured credit cards ($200-500 deposits)

- Credit-builder loans from Self or Credit Strong

- Becoming an authorized user on a family member’s old account

Frequently Asked Questions

How long will it take to reach 620?

With focused effort (paying down balances, disputing errors), most people see a 20-40 point jump in 60-90 days. However, late payments take 7 years to fully age off your report.

Will a credit repair company help?

Some can dispute errors effectively, but avoid companies promising “credit sweeps.” For DIY steps, see our Credit Repair Companies Exposed guide.

Should I close old collection accounts?

Not necessarily. Paid collections still hurt for 7 years. Focus on disputing inaccuracies first using our collections removal guide.

How long will it take to reach 620?

With focused effort (paying down balances, disputing errors), most people see a 20-40 point jump in 60-90 days. However, late payments take 7 years to fully age off your report.

Ready to Build Better Credit?

Track your progress with free FICO® score access and personalized tips.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring