620-659 Credit Score:

The ‘Almost Good’ Credit Zone Explained

You’re so close to a “Good” credit score (660+), but not quite there. A 620-659 credit score is like being stuck in financial purgatory—you’ll qualify for some loans, but at higher rates, and premium credit cards remain just out of reach.

This guide breaks down:

✔ What this score range means for your finances.

✔ How to improve it (fast and long-term).

✔ Loan/Credit opportunities (and harsh realities).

Let’s get you into the “Good” zone!

🔍 What Does a 620-659 Credit Score Really Mean?

This range is fair-to-almost-good, according to FICO® and VantageScore®. Here’s the breakdown:

| Credit Score Range | Rating |

|---|---|

| 580-619 | Poor |

| 620-659 | Fair/Almost Good |

| 660-719 | Good |

Pros:

✅ Can qualify for FHA mortgages (min. 620).

✅ Some auto loans (but expect higher APRs).

✅ Basic credit cards (secured/unsecured with fees).

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →Cons:

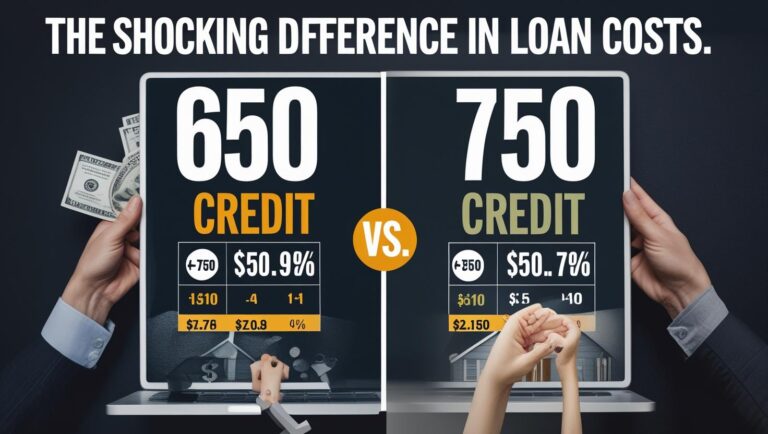

❌ Higher interest rates (costing you thousands over time).

❌ Rentals/utilities may require deposits.

❌ Premium rewards cards (e.g., Chase Sapphire) likely decline you.

💡 Key Insight:

*”Lenders see 620-659 borrowers as ‘medium risk’—you’ll pay more for credit, but you’re not shut out completely.”*

📉 Why Is My Score Stuck Here?

Common culprits:

- High credit utilization (>30% of limits).

- Late payments (even one 30-day late can hurt).

- Thin credit file (short history or few accounts).

- Collections/errors dragging you down.

▶️ Quick Fix:

Check your credit report for free at AnnualCreditReport.com (no score, just data).

| Credit Score Range | Rating |

|---|---|

| 580-619 | Poor |

| 620-659 | Fair/Almost Good |

| 660-719 | Good |

| Financial Product | Approval Odds | Notes |

|---|---|---|

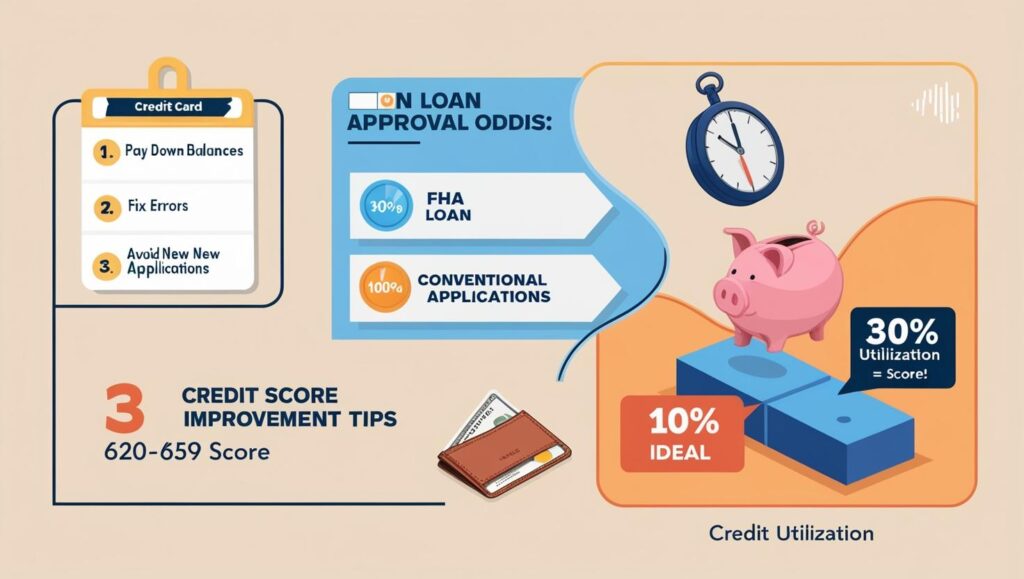

| FHA Mortgage | ✅ Likely | Min. 620 |

| Conventional Mortgage | ❌ Unlikely | Usually 660+ |

| Auto Loan | ✅ Likely | High APR (8%+) |

| Premium Credit Card | ❌ Rare | Secured cards only |

🔹 Can I get a mortgage with a 620 score?

Yes, but only FHA loans (3.5% down payment required). Conventional loans typically demand 660+. Learn more about FHA loans here.

🔹 How fast can I reach 660+?

With focused effort (paying down debt, fixing errors), 3–12 months. Slow and steady wins!

🔹 Should I use a credit repair company?

Some can help dispute errors, but you can do it yourself for free. Avoid companies promising “quick fixes”—read the FTC’s warning first.

🚀 How to Improve a 620-659 Score

Fast Actions (1-3 Months):

- Pay down balances to under 30% utilization (ideally 10%).

- Dispute errors (e.g., false late payments) via Credit Karma or directly with bureaus.

- Ask for higher limits (lowers utilization without new debt).

Long-Term Wins (6+ Months):

- Set up autopay to avoid late payments.

- Become an authorized user on a family member’s old account.

- Mix credit types (e.g., add a small installment loan).

⚠️ Avoid:

- Closing old accounts (shortens credit history).

- Applying for multiple cards/loans (hard inquiries hurt).

Need a boost? Explore credit-building tools here.

💳 What Can You Get with a 620-659 Score?

| Financial Product | Approval Odds | Notes |

|---|---|---|

| FHA Mortgage | ✅ Likely | Min. 620 |

| Conventional Mortgage | ❌ Unlikely | Usually 660+ |

| Auto Loan | ✅ Likely | High APR (8%+) |

| Premium Credit Card | ❌ Rare | Secured cards only |

Tip: Some lenders specialize in “near-prime” borrowers—compare offers!

🔹 Can I get a mortgage with a 620-659 credit score?

Yes, but only FHA loans (minimum 620 score). Conventional mortgages typically require 660+. Learn more about FHA loan requirements here.

🔹 How long does it take to reach a ‘Good’ credit score (660+)?

With consistent effort (paying down balances, fixing errors), most people see progress in 3–12 months. Quick wins like lowering utilization can boost scores faster.

🔹 Will a credit repair company help improve my 620-659 score?

Some can dispute errors, but you can do this yourself for free. Avoid companies promising “guaranteed” fixes—the FTC warns against scams.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring