780-850 Credit Score

How to Keep Your CRedit |Score High A 780-850 credit score puts you in the “Exceptional” tier – the top tier of borrowers that lenders compete to serve. But what does this really mean for your wallet? “When I hit 800, my…

How to Keep Your CRedit |Score High A 780-850 credit score puts you in the “Exceptional” tier – the top tier of borrowers that lenders compete to serve. But what does this really mean for your wallet? “When I hit 800, my…

📌 A 740-779 credit score puts you in the “Very Good” tier—just shy of “Exceptional” (800+). With this score, you’ll qualify for the lowest interest rates on loans, premium credit cards, and better negotiating power. Here’s how to maximize it. What a…

Here’s Your Gap Analysis for a 700 to 739 Credit Score You’re in the top 35% of U.S. credit scores—ahead of most borrowers, but still missing the golden 740+ tier that unlocks: ✅ 1.9% auto loans (vs. your current 4.9%+) ✅ Chase Sapphire Reserve®…

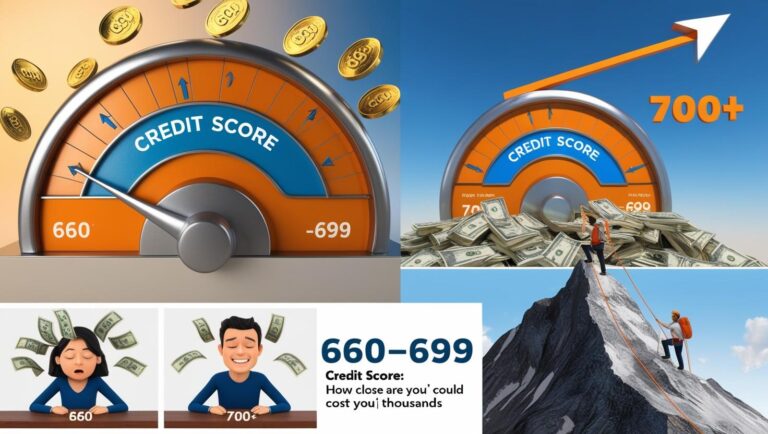

How Close Are You to a ‘Good’ Credit Score? You’re so close to the coveted 700+ “Good” credit tier – but that last 1-40 point gap could be costing you thousands in extra interest. This guide reveals:✔ Exactly what financial doors a 660-699 score opens…

The ‘Almost Good’ Credit Zone Explained You’re so close to a “Good” credit score (660+), but not quite there. A 620-659 credit score is like being stuck in financial purgatory—you’ll qualify for some loans, but at higher rates, and premium credit cards remain just…

What it means for you : A 580-619 Credit Score ! Key Takeaway: A 580-619 credit score is considered “Fair” by FICO® standards. While you’ll qualify for some financial products, you’re paying higher interest rates and missing out on the…

Understand & Improve Your Credit Score Your Credit Score: A Complete Guide Your credit score is your financial fingerprint. This 3-digit number (300-850) affects loan approvals, interest rates, and much more. Credit Score Ranges: How Lenders See You Score Range…

Free Credit Repair Tools (2025 Updated) 2025 Tax Lien Removal Kit AI-Optimized Dispute Letters State-Specific Loophole Guide Bureau Fax/Email Direct Lines Download Now → Credit Error Dispute Pack 3 Bureau Dispute Templates CFPB Complaint Generator Creditor Negotiation Scripts Download Now…

Avoid Unnecessary Debt Description: Avoiding unnecessary debt involves making conscious financial decisions to prevent accumulating liabilities that do not contribute to long-term financial stability or growth. This includes steering clear of high-interest loans, impulse purchases, and lifestyle inflation. Why It…

Monitoring your credit score involves regularly checking your credit report and score to ensure accuracy, track changes, and identify potential issues. Why It Matters: Your credit score impacts your ability to secure loans, credit cards, and favorable interest rates. It…