Understanding Credit Utilization and Its Effect on Credit Scores

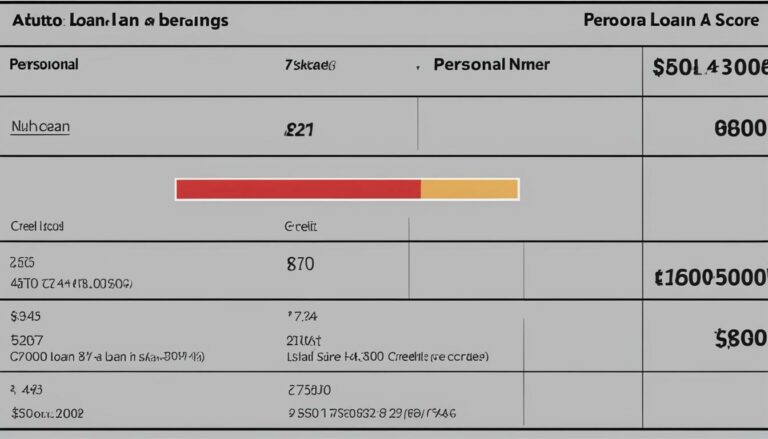

Credit utilization plays a significant role in determining your credit scores and understanding its impact is crucial for managing your credit effectively. Credit utilization refers to the amount of debt you owe compared to the total credit available to you,…