Master Credit Reporting for Unconventional Loans Today

In today’s financial landscape, understanding credit reporting for unconventional loans is crucial for informed decision-making. Whether you’re looking to secure a loan for a small business, investment property, or personal venture, credit reporting services and agencies play a vital role in determining your eligibility and creditworthiness.

- Credit reporting for unconventional loans is essential in making informed financial decisions.

- Traditional credit scores may not accurately reflect an individual’s creditworthiness.

- Lenders are turning to alternative data sources to assess loan eligibility.

- Alternative data includes bank account transactions, rental and utility payments, and educational background.

- Concerns regarding discrimination, fair lending violations, and data privacy risks exist.

The Role of Alternative Data in Credit Reporting

Traditional credit scores may not capture the complete financial picture, leading lenders to explore alternative data for a more accurate credit reporting solution. For those individuals who lack credit scores or have limited credit history, alternative data sources are becoming increasingly valuable in assessing loan eligibility. By incorporating additional data points, lenders can gain a more holistic view of an individual’s creditworthiness.

Alternative data includes various non-traditional sources such as on-time rental and utility payments, bank account transactions, and educational background. These sources provide valuable insights into an individual’s financial behavior and repayment history, allowing lenders to make more informed lending decisions.

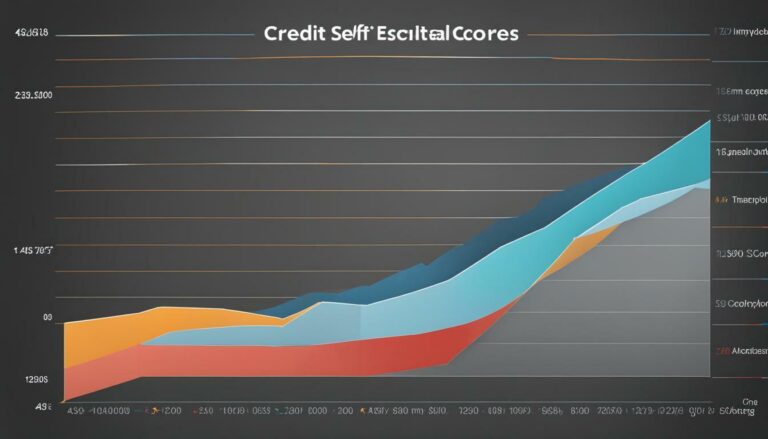

One of the advantages of alternative data in credit reporting is the ability to help individuals establish or improve their credit scores. By considering alternative data, individuals who may have been overlooked by traditional scoring models now have an opportunity to showcase their creditworthiness. This inclusion can open doors to better loan terms, lower interest rates, and more favorable financial opportunities.

Exploring Alternative Data Sources

When it comes to alternative loan credit reporting, several data sources play a crucial role. These include:

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →- On-time rental and utility payments: Timely payments for rent and utilities can demonstrate responsible financial behavior and reliability.

- Bank account transactions: Analyzing transactional data allows lenders to assess income stability, spending habits, and overall financial health.

- Educational background: Educational achievements can be indicative of future earning potential and financial responsibility.

By incorporating these alternative data sources, lenders can make fairer and more accurate credit assessments, ensuring individuals have access to the financial opportunities they deserve.

| Advantages | Description |

|---|---|

| Broader Assessment | Alternative data provides a more comprehensive view of an individual’s creditworthiness beyond traditional credit scores. |

| Inclusion of Underserved Populations | Alternative data helps to include individuals with limited credit history or no credit scores in the lending ecosystem. |

| Improved Loan Terms | By considering alternative data, lenders can offer better loan terms, lower interest rates, and increased access to financial opportunities. |

| Financial Inclusion | Alternative data enhances financial inclusion by providing opportunities to individuals who have been traditionally underserved by the credit system. |

In conclusion, alternative data plays an essential role in credit reporting for non-traditional loans. By incorporating alternative data sources, lenders can create a more accurate and inclusive credit assessment process, benefiting borrowers who may not have strong traditional credit scores. It is crucial for individuals seeking unconventional loans to understand the value of alternative data and actively consider opt-in options provided by private companies or credit bureaus to ensure their credit scores reflect their true creditworthiness.

Challenges and Concerns in Credit Reporting for Unconventional Loans

Despite the potential benefits, credit reporting for unconventional loans comes with challenges that need to be carefully addressed. One of the primary concerns is credit reporting policies that may inadvertently discriminate against certain individuals or demographics. The reliance on alternative data sources introduces the risk of unfair lending practices or inadvertently perpetuating existing biases.

Another challenge lies in ensuring the accuracy of credit reports. While traditional credit reporting has its own set of challenges, incorporating alternative data brings additional complexities. The use of non-traditional data sources may lead to inaccuracies or misinterpretations, which can impact an individual’s loan eligibility and overall creditworthiness. There is a need for standardized reporting guidelines and stringent quality control measures to mitigate these risks.

“Credit reporting policies must strike a delicate balance between improving access to credit for individuals with limited credit history and protecting consumer rights and privacy.”

Data privacy is yet another concern in credit reporting for unconventional loans. The use of alternative data sources, such as bank account transactions and rental payment history, involves handling sensitive personal information. It is crucial to safeguard this data against unauthorized access and misuse. Stricter regulations and robust data protection measures are necessary to ensure the privacy and security of individuals’ financial information.

Data Privacy Risks

One of the key concerns in credit reporting for unconventional loans is the potential data privacy risks associated with alternative data sources. As more personal information is collected and analyzed, individuals become vulnerable to potential data breaches and privacy violations. Malicious actors can misuse this information for identity theft or fraudulent activities. Therefore, it is imperative for credit reporting agencies and lenders to adopt stringent security measures to protect individuals’ data and maintain their trust.

| Challenge | Concern |

|---|---|

| Credit Reporting Policies | Potential discrimination and unfair lending practices |

| Credit Report Accuracy | Possible inaccuracies and misinterpretations |

| Data Privacy Risks | Potential data breaches and privacy violations |

In conclusion, while credit reporting for unconventional loans opens doors for individuals with limited credit history, it also poses challenges that need careful consideration. Addressing concerns related to credit reporting policies, ensuring the accuracy of credit reports, and mitigating data privacy risks are crucial steps in building a fair and secure credit reporting system for unconventional loans. It is essential for industry stakeholders, policymakers, and consumers to work together to strike the right balance between expanding credit access and protecting consumer rights.

Opting-In for Alternative Data in Credit Scores

If you want alternative data to be considered in your credit scores, there are ways to opt-in and actively monitor your credit report. Traditional credit scores are based on limited information, such as payment history, credit card usage, and loan status. However, lenders now recognize that these scores may not accurately represent an individual’s creditworthiness, especially for those with limited credit history or no recent credit activity.

Alternative data, such as bank account transactions, on-time rental and utility payments, and educational background, can provide a more comprehensive assessment of an individual’s creditworthiness. By including this additional information in credit reports, lenders can make more informed decisions when evaluating loan applications.

To opt-in for alternative data inclusion in your credit scores, you can explore credit products offered by private companies or credit bureaus. These products are specifically designed to help individuals establish or improve their credit profiles using alternative data sources. By enrolling in these programs, you give lenders access to a wider range of information, which may increase your chances of loan approval.

The Benefits of Regularly Monitoring Your Credit Report

Actively monitoring your credit report is an essential step in the credit reporting process. It allows you to stay informed about the accuracy of your credit information and identify any discrepancies or errors that could affect your credit scores. Regularly reviewing your credit report also helps you detect signs of identity theft or fraudulent activity.

By monitoring your credit report, you can take timely actions to correct any inaccuracies and ensure that your credit information is up to date. This can be done through various credit monitoring services provided by credit bureaus or other reputable companies. These services notify you of any changes or updates to your credit report, enabling you to proactively manage your credit and maintain a healthy credit profile.

| Benefits of Opting-In for Alternative Data in Credit Scores |

|---|

| Access to a more comprehensive assessment of creditworthiness for unconventional loans |

| Increased chances of loan approval |

| Improved credit scores and credit profile |

| Opportunity to correct any inaccuracies or errors in your credit report |

| Early detection of identity theft or fraudulent activity |

Conclusion

Mastering credit reporting for unconventional loans is essential for making informed financial decisions and ensuring the accuracy of your credit report. With the increasing reliance on alternative data, lenders are now able to consider a wider range of factors when assessing loan eligibility, allowing individuals with limited credit history or unconventional financial situations to access credit opportunities.

Traditional credit scores are calculated based on payment history, credit card and mortgage payments, and active loan status. However, around 45 million Americans lack credit scores due to limited credit history or lack of recent credit use. This is where alternative data comes in, offering a more comprehensive assessment by considering factors such as bank account transactions, on-time rental and utility payments, and even educational background.

While alternative data can help individuals establish or improve their credit scores, it is important to address the concerns associated with its use. Fair lending violations, potential discrimination, and data privacy risks are some of the challenges that need to be carefully managed. However, with proper regulations and transparent practices, alternative data can be a valuable tool for both lenders and borrowers.

If you want alternative data included in your credit scores, you have the option to opt-in to credit products offered by private companies or credit bureaus. By actively monitoring your credit reports, you can stay informed about the accuracy of the information being reported and take steps to correct any errors that may affect your creditworthiness. Regular credit report monitoring is crucial for individuals seeking unconventional loans, as it allows you to proactively manage your credit and ensure that your financial profile accurately reflects your creditworthiness.

FAQ

Q: What is the role of credit reporting for unconventional loans?

A: Credit reporting for unconventional loans is crucial in determining loan eligibility. It helps lenders assess an individual’s creditworthiness and financial stability.

Q: How are traditional credit scores calculated?

A: Traditional credit scores are calculated based on various factors, including payment history, credit card and mortgage payments, and active loan status.

Q: What are alternative data sources in credit reporting?

A: Alternative data sources in credit reporting include bank account transactions, on-time rental and utility payments, and educational background, among others.

Q: What are the concerns in using alternative data for credit reporting?

A: Concerns include potential discrimination, fair lending violations, and data privacy risks associated with handling alternative data.

Q: How can individuals include alternative data in their credit scores?

A: Individuals can opt-in for alternative data inclusion in their credit scores by utilizing credit products offered by private companies or credit bureaus.

Q: Why is it important to regularly monitor credit reports for unconventional loans?

A: Regularly monitoring credit reports helps ensure accuracy and enables individuals to stay informed about their creditworthiness, especially when seeking unconventional loans.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring