Mastering Credit Reporting for Small Business Owners Guide

As a small business owner, understanding credit reporting is crucial for the success and growth of your business. Credit reporting plays a vital role in determining your creditworthiness, which can directly impact your ability to secure loans, obtain favorable interest rates, and establish trade credit accounts. In this guide, we will delve into the world of credit reporting for small business owners, providing you with valuable insights and practical tips to help you navigate this complex landscape.

Key Takeaways:

- Building positive credit through trade credit accounts can enhance your creditworthiness.

- Paying bills on time or early is crucial for maintaining a good business credit score.

- Regularly checking your credit reports and disputing any errors is essential for accurate credit reporting.

- Understanding business credit scores can increase your chances of loan approval.

- The Federal Trade Commission (FTC) is actively working to improve credit reporting practices for small businesses.

The Basics of Credit Reporting for Small Business Owners

Building a solid credit history is essential for small business owners to access financing and establish credibility in the business world. When applying for credit, it’s important to be cautious and avoid applying for too many credit cards or loans at once. This can raise red flags for lenders and credit bureaus, potentially lowering your credit score. Instead, focus on building positive credit by opening trade credit accounts with vendors who report to credit bureaus. This demonstrates your ability to manage credit responsibly and can contribute to a positive credit history.

Paying bills on time or even early is crucial for maintaining a good business credit score. Late payments or defaults can have a significant negative impact on your creditworthiness. By consistently meeting payment deadlines, you demonstrate reliability and financial responsibility to lenders.

Regularly checking your credit reports is another important step in managing your business credit. Monitoring your reports allows you to identify any errors or discrepancies that may be negatively affecting your credit. If you find any inaccuracies, it’s essential to dispute them with the credit bureaus to ensure the accuracy of your credit information.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →

Understanding how business credit scores are calculated can increase your chances of loan approval. Factors such as payment history, credit utilization, length of credit history, and public records can all influence your credit score. By familiarizing yourself with these factors, you can make informed decisions to improve your creditworthiness.

The Federal Trade Commission (FTC) plays a crucial role in ensuring accuracy and protections in the small business credit reporting system. They are actively investigating and implementing measures to enhance credit reporting practices for small businesses, providing a safer and fairer credit environment.

When it comes to business credit cards, there are various options available to small business owners. Secured, unsecured, rewards, cashback, and points cards each offer unique benefits. Choosing the right card depends on your specific business needs and financial goals. However, eligibility for business credit cards often depends on factors such as credit scores, business revenue, age, and structure.

Lastly, when comparing business credit card options, it’s important to consider interest rates, APRs, balance transfer options, fees, and promotional rates. Maximizing credit limits and effectively managing expenses using business credit cards can help small business owners maintain financial stability and take advantage of various perks offered by credit card companies.

Tips for Building and Maintaining Good Business Credit

To improve your business creditworthiness, it’s crucial to adopt practices that positively impact your credit scores and maintain a clean credit report. Building a strong business credit profile takes time and effort, but it’s well worth it in the long run. Here are some tips to help you build and maintain good business credit:

- Pay bills on time or early: Timely bill payment is one of the most critical factors in establishing good business credit. Late or missed payments can have a negative impact on your credit scores. Make it a priority to pay all your bills, including utilities, rent, and vendor invoices, on time or even before the due date.

- Open trade credit accounts: Trade credit accounts with vendors who report to credit bureaus can help you build positive credit. Make sure to choose vendors who regularly report payment history to the credit bureaus. By consistently making payments and building a positive credit history, you can improve your business credit scores.

- Regularly check your credit reports: It’s essential to periodically review your credit reports to ensure their accuracy. Mistakes or errors on your credit report can negatively impact your business credit scores. If you find any discrepancies, you should take immediate steps to dispute and correct them.

Understanding your business credit scores is crucial for making informed decisions about your creditworthiness. Lenders and creditors use these scores to assess your creditworthiness and determine whether to approve loan applications. By understanding the factors that influence your business credit scores, you can take proactive steps to improve them. Factors such as payment history, credit utilization, length of credit history, and public records can all impact your creditworthiness.

Maximizing Business Credit Card Benefits

Business credit cards can be powerful tools for managing expenses and earning rewards. However, it’s essential to choose the right business credit card that aligns with your specific needs and financial goals. Consider the following factors when selecting a business credit card:

- Interest rates and APRs: Look for cards with competitive interest rates and APRs to avoid unnecessary finance charges.

- Promotional rates and fees: Some credit cards offer promotional rates or waived fees for a specific period. Assess these offers and compare them to find the best fit for your business.

- Balance transfer options: If you have existing credit card debt, consider a card that offers favorable balance transfer terms to consolidate your debt and save on interest.

Remember that eligibility for business credit cards depends on factors like credit scores, business revenue, age, and structure. It’s crucial to maintain good credit scores and manage your business finances responsibly to increase your chances of being approved for the cards you desire.

Understanding Business Credit Scores

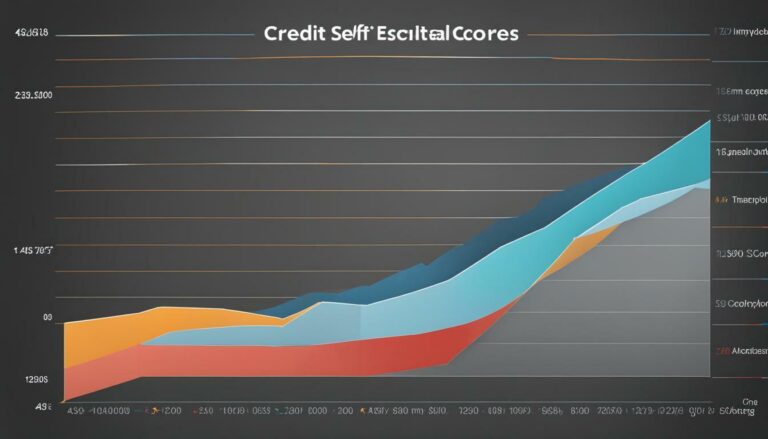

Business credit scores can greatly impact your ability to secure loans and favorable terms, making it essential to understand how they are calculated. Just like personal credit scores, business credit scores are used by lenders and creditors to assess the creditworthiness of a company. These scores are based on a variety of factors, including payment history, credit utilization, length of credit history, and public records.

One common credit scoring model used for business credit is the Paydex score, developed by Dun & Bradstreet. The Paydex score ranges from 0 to 100, with higher scores indicating better creditworthiness. It is calculated based on the payment history of a business, taking into account factors such as how promptly bills are paid and the number of delinquent payments. A high Paydex score can increase the likelihood of loan approval and better terms.

Another important aspect of business credit scores is the utilization ratio, which measures the percentage of available credit that a business is using. Lenders prefer to see low utilization ratios, as it indicates responsible credit management and a lower risk of default. It is recommended to keep the utilization ratio below 30%, ideally even lower if possible.

| Business Credit Score | Rating |

|---|---|

| 80-100 | Low Risk |

| 50-79 | Medium Risk |

| 0-49 | High Risk |

“A high business credit score demonstrates that you are a reliable borrower and can be trusted to repay your debts on time. It opens up doors to better financing options and more favorable terms.”

Summary:

- Business credit scores play a crucial role in securing loans and favorable terms.

- The Paydex score is a common credit scoring model used for businesses.

- A low utilization ratio is preferred by lenders, indicating responsible credit management.

The Federal Trade Commission plays a vital role in ensuring the accuracy and fairness of credit reporting processes for small businesses. Factual data shows that mastering credit reporting for small business owners involves being cautious about applying for too many credit cards or loans at once, as it can raise red flags for lenders and credit bureaus. It’s beneficial to open trade credit accounts with vendors who report to credit bureaus, as this helps build positive credit. Additionally, paying bills on time or even early is crucial for maintaining a good business credit score.

Regularly checking credit reports and promptly disputing any errors is also critical. By understanding business credit scores, small business owners can increase the likelihood of loan approval. This is why the FTC is currently investigating the small business credit reporting system, aiming to enhance accuracy and provide better protections for businesses. With the availability of different types of business credit cards, such as secured, unsecured, rewards, cashback, and points cards, small business owners have options to choose from depending on their needs and preferences.

When comparing business credit card options, it is essential to consider factors such as interest rates, APRs, balance transfers, fees, and promotional rates. Eligibility for business credit cards is dependent on various factors, including credit scores, business revenue, age, and structure. Maximizing credit limits and effectively managing expenses using business credit cards are also crucial for small business owners. Taking these factors into account will help small business owners make informed decisions about credit reporting and effectively manage their financial resources.

Exploring Business Credit Card Options

Business credit cards can be powerful tools for managing expenses and building credit, with various options available to cater to different business needs. Whether you are a small business owner looking to establish credit or a seasoned entrepreneur seeking rewards and cashback benefits, there is a business credit card that can meet your requirements.

When it comes to choosing a business credit card, it’s essential to consider the features and benefits offered by different card issuers. Here are some types of business credit cards you may come across:

- Secured Business Credit Cards: Ideal for business owners with limited or poor credit history, secured cards require a cash deposit as collateral. They can help you build or rebuild credit while still enjoying the convenience and benefits of a credit card.

- Unsecured Business Credit Cards: These cards do not require any collateral, making them suitable for established businesses with a solid credit history. They often come with higher credit limits and additional perks.

- Rewards Credit Cards: These cards offer rewards, such as cashback, points, or miles, for eligible purchases. If your business regularly spends on travel, office supplies, or other specific categories, a rewards credit card can help you earn valuable benefits.

- Cashback Credit Cards: Designed for businesses that prioritize cash savings, cashback cards provide a percentage of cashback on eligible purchases. This can be especially beneficial for businesses that make frequent purchases in specific categories like gas, dining, or office supplies.

- Points Credit Cards: Similar to rewards credit cards, points cards allow you to earn points for eligible purchases. These points can be redeemed for a variety of rewards, such as merchandise, gift cards, or travel.

When comparing business credit card options, it’s important to consider factors beyond just the type of card. Take into account interest rates, annual percentage rates (APRs), balance transfer options, and any associated fees. Additionally, eligibility for business credit cards may be determined by factors such as personal and business credit scores, revenue, business age, and business structure.

| Card Type | Interest Rate | Annual Fee | Card Benefits |

|---|---|---|---|

| Secured | Variable, typically higher | May have an annual fee | Build credit, potential cashback or rewards |

| Unsecured | Variable, typically lower | May have an annual fee, sometimes waived for the first year | Higher credit limits, potential rewards |

| Rewards | Variable, typically moderate | May have an annual fee | Cashback, points, or miles for eligible purchases |

| Cashback | Variable, typically moderate | May have an annual fee | Cashback on eligible purchases |

| Points | Variable, typically moderate | May have an annual fee | Points for eligible purchases, redeemable for rewards |

Maximizing your credit limits and managing your business expenses using business credit cards can contribute to building a strong credit profile. By paying your credit card bills on time and in full, you demonstrate financial responsibility and improve your creditworthiness. Remember to review the terms and conditions of each card carefully and select the one that aligns with your business objectives and financial capabilities.

Choosing the right business credit card requires careful evaluation of factors like interest rates, fees, and eligibility criteria tailored to your business’s unique needs. By understanding these key considerations, you can make an informed decision that aligns with your financial goals and maximizes the benefits for your small business.

Interest rates play a crucial role in determining the cost of borrowing on your business credit card. It’s important to compare the Annual Percentage Rates (APRs) offered by different card issuers. Lower interest rates can save your business money in the long run, especially if you anticipate carrying a balance on the card. Look for promotional rates that offer introductory periods with low or 0% APR, but be aware of any potential rate hikes once the promotional period ends.

Fees are another important factor to consider. Some business credit cards charge an annual fee, while others may have transaction fees, balance transfer fees, or foreign transaction fees. Evaluate these fees and consider how they align with your business’s cash flow and spending habits. Additionally, be aware of any late payment or over-limit fees, as they can negatively impact your finances if not managed properly.

Eligibility criteria

Eligibility criteria for business credit cards can vary. Some cards may require a certain credit score range, typically above 670, while others may have lower thresholds. Your business’s revenue, age, and structure may also play a role in determining your eligibility. Before applying, it’s important to understand the criteria set by the card issuer and assess how well your business meets these requirements.

Maximizing credit limits and managing expenses using business credit cards is crucial for small business owners looking to enhance their financial flexibility. By using your business credit card responsibly and making timely payments, you can establish a positive credit history and improve your creditworthiness for future financing needs.

By carefully evaluating factors such as interest rates, fees, and eligibility criteria, you can choose a business credit card that complements your business’s financial objectives. Remember to read the fine print, compare offers, and consider consulting with a financial advisor or credit expert to ensure you make an informed decision. Using a business credit card wisely can provide your small business with the financial tools it needs to thrive.

| Factor | Considerations |

|---|---|

| Interest Rates | Compare APRs, look for promotional rates, and be aware of potential rate hikes. |

| Fees | Evaluate annual fees, transaction fees, balance transfer fees, foreign transaction fees, late payment fees, and over-limit fees. |

| Eligibility Criteria | Assess credit score requirements, revenue, age, and structure of your business. |

Conclusion

Mastering credit reporting for your small business is essential to establish a strong financial foundation and unlock opportunities for growth. By being cautious about applying for too many credit cards or loans at once, you can avoid raising red flags for lenders and credit bureaus. Instead, focus on opening trade credit accounts with vendors who report to credit bureaus, as this can help build positive credit history.

Paying your bills on time or even early is crucial for maintaining a good business credit score. This demonstrates your reliability and financial responsibility to lenders and can increase your chances of securing favorable loan terms and interest rates. Additionally, regularly checking your credit reports and disputing any errors is important to ensure the accuracy of your credit history.

Understanding business credit scores is also key to improving your creditworthiness. By familiarizing yourself with how these scores are calculated and what factors influence them, you can take proactive steps to optimize your credit profile. This knowledge can be invaluable when applying for loans or other forms of credit.

Protecting Your Business

The Federal Trade Commission (FTC) is actively involved in investigating and improving the small business credit reporting system. Their efforts aim to ensure accuracy and protections for businesses like yours. By monitoring their investigations and staying informed about any changes or initiatives, you can stay ahead and make informed decisions regarding your credit reporting practices.

Business credit cards offer various options for small business owners, providing access to capital and additional financial flexibility. From secured and unsecured cards to rewards, cashback, and points cards, each option has its own benefits and considerations. When comparing business credit card options, it’s crucial to consider factors such as interest rates, APRs, balance transfer options, fees, and promotional rates. Assessing your eligibility based on credit scores, business revenue, age, and structure is also important in finding the right fit for your business.

Maximizing credit limits and managing expenses using business credit cards can be a smart financial strategy. However, it’s essential to use these tools responsibly and avoid accumulating excessive debt. By maintaining a strong credit history and actively managing your credit, you can position your small business for success and growth.

FAQ

What is the importance of credit reporting for small business owners?

Credit reporting is crucial for small business owners as it determines their creditworthiness and can impact loan approvals and interest rates.

What should small business owners be cautious about when applying for credit?

Small business owners should be cautious about applying for too many credit cards or loans at once, as it can raise red flags for lenders and credit bureaus.

What are trade credit accounts, and why are they beneficial?

Trade credit accounts are accounts with vendors who report to credit bureaus. They are beneficial for small business owners as they help build positive credit history.

Why is paying bills on time or early crucial for maintaining good business credit?

Paying bills on time or early is crucial for maintaining a good business credit score as it demonstrates responsible financial management.

Why is it important to periodically check credit reports and dispute any errors?

Periodically checking credit reports and disputing any errors is important to ensure the accuracy of business credit information and maintain a strong credit profile.

How can understanding business credit scores increase the likelihood of loan approval?

Understanding business credit scores allows small business owners to identify areas for improvement and take proactive steps to increase their creditworthiness, increasing the likelihood of loan approval.

What is the role of the FTC in small business credit reporting?

The FTC is investigating the small business credit reporting system to ensure accuracy and protections for businesses. They are working to enhance credit reporting practices for small businesses.

What types of business credit cards are available to small business owners?

Small business owners have various options for business credit cards, including secured, unsecured, rewards, cashback, and points cards, each with its own benefits.

What factors should be considered when choosing a business credit card?

When choosing a business credit card, factors to consider include interest rates, APRs, balance transfers, fees, promotional rates, and eligibility criteria based on credit scores, business revenue, age, and structure.

Why is maximizing credit limits and managing expenses crucial for small business owners?

Maximizing credit limits and managing expenses using business credit cards is crucial for small business owners as it helps maintain a healthy credit utilization ratio and demonstrates responsible financial management.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring