Mastering the Art of Navigating Credit in a Cashless Society

body {

font-family: Arial, sans-serif;

}

h1 {

font-size: 24px;

font-weight: bold;

margin: 20px 0;

}

p {

font-size: 16px;

margin: 10px 0;

}

img {

display: block;

margin: 20px auto;

width: 400px;

}

h3 {

font-size: 18px;

font-weight: bold;

margin: 10px 0;

}

ul {

list-style-type: disc;

margin-left: 20px;

margin-bottom: 20px;

}

In today’s cashless society, mastering the art of navigating credit is essential for effectively managing your finances. With the increasing prevalence of digital payment methods and the shift away from cash transactions, understanding credit card usage and the benefits of cashless transactions is crucial.

- Navigating credit in a cashless society requires adapting to digital payment methods.

- Convenience is a major advantage of using credit cards, Apple Pay, and Venmo.

- Privacy risks and potential exclusion from the financial system are concerns to consider.

- Legal challenges may arise for businesses that refuse to accept cash.

- Increased prices and interchange fees are costs associated with going cashless.

The Convenience of Digital Payment Methods

The rise of digital payment methods has revolutionized the way we handle transactions, offering unparalleled convenience and flexibility. With credit cards, Apple Pay, Venmo, and other digital wallets, you can make purchases with just a few taps on your smartphone or a swipe of your card. No more fumbling for cash or waiting for change.

One of the advantages of digital payment methods is their widespread acceptance in a cashless economy. Credit cards have become a staple in our wallets, allowing us to make purchases at numerous establishments without the need for physical currency. Similarly, mobile payment options like Apple Pay and Google Pay have made it even easier to complete transactions with just a touch of your phone.

Another benefit of digital payment methods is the ability to track and manage your spending. By linking your credit card or digital wallet to budgeting apps, you can effortlessly monitor your expenses and stay on top of your financial goals. This level of transparency and control can help you make more informed decisions about your money.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →

When it comes to mobile payment options, there are a multitude of choices available. From the simplicity of using Apple Pay on your iPhone to the convenience of Venmo for peer-to-peer transactions, each platform offers its unique features and benefits. For example, Venmo allows you to split bills with friends, making it easier to handle expenses when dining out or sharing costs for a group activity.

| Payment Method | Key Features |

|---|---|

| Apple Pay | Seamless integration with iPhone and Apple devices. Secure and contactless transactions. |

| Google Pay | Available on Android devices. Offers rewards and loyalty programs. |

| Venmo | Easy peer-to-peer payments and splitting bills. Social feed to interact with friends. |

These mobile payment options provide a level of convenience that cash simply cannot match. Whether you’re making a quick purchase at a store or paying back a friend for dinner, digital payment methods offer a faster, more efficient way to handle transactions in our increasingly cashless society.

- Convenience and flexibility of digital payment methods

- Widespread acceptance in a cashless economy

- Ability to track and manage spending

- Variety of mobile payment options available

Concerns and Considerations in a Cashless Society

While the convenience of a cashless society is undeniable, there are important concerns and considerations that must be taken into account when it comes to managing credit. As more transactions are conducted digitally, privacy risks become a pressing issue. With every swipe of a credit card or tap on a mobile payment app, personal information is shared and stored, making individuals vulnerable to identity theft and fraud. It is crucial for consumers to be vigilant in protecting their privacy and to choose reputable and secure platforms for their digital transactions.

Another concern is the potential impact of a cashless society on credit management. While digital payment methods offer convenience and efficiency, they also have the potential to create a divide between those who have access to credit and those who do not. Certain individuals, such as those without bank accounts or with limited access to technology, may find it difficult to participate fully in a cashless economy. This could lead to financial exclusion and a widening wealth gap. It is imperative that efforts are made to ensure equal access to credit and financial services for all members of society.

Protecting Your Privacy

To mitigate privacy risks in a digital world, it is important to take proactive steps. First and foremost, it is recommended to regularly monitor your credit reports for any suspicious activity and to promptly report any unauthorized transactions. Additionally, individuals should be cautious about sharing personal information online and should avoid using public Wi-Fi networks for financial transactions. Implementing two-factor authentication and using strong, unique passwords for each online account can add an extra layer of security.

Furthermore, staying educated about the latest security practices and keeping software up to date on all devices can help minimize the risk of privacy breaches. By remaining vigilant and informed, individuals can navigate the challenges of a cashless society with confidence and safeguard their personal information.

| Privacy Protection Tips |

|---|

| Avoid sharing personal information online. |

| Regularly monitor credit reports for unauthorized activity. |

| Use strong, unique passwords for each online account. |

| Implement two-factor authentication for added security. |

| Avoid using public Wi-Fi networks for financial transactions. |

| Stay informed about the latest security practices and updates. |

As society continues to embrace a cashless future, it is crucial to address the concerns and considerations that arise in managing credit in a digital world. By prioritizing privacy protection and ensuring equal access to credit, we can navigate the challenges and reap the benefits of a cashless society while safeguarding our financial well-being.

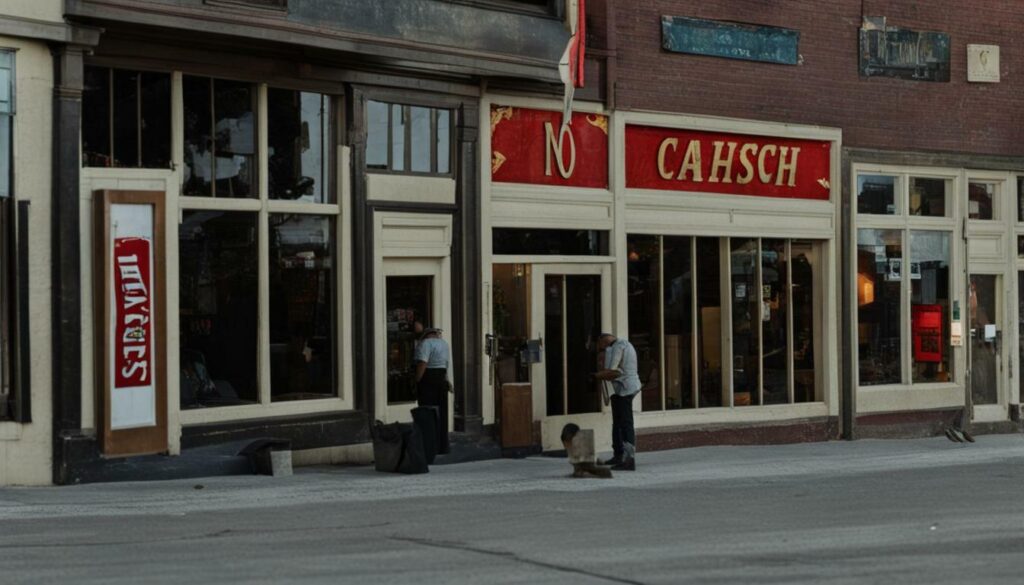

Legal Challenges and the Acceptance of Cash

The refusal of cash by businesses has sparked legal debates and raised questions about the rights of consumers and the potential consequences for financial inclusion. In recent years, some establishments, particularly in urban areas, have begun to only accept digital forms of payment, such as credit cards or mobile payment options. While this move towards a cashless society may be seen as progressive and convenient, it has faced legal challenges and criticism.

One notable example of legal challenges arising from the refusal of cash can be seen in the case of Van Leeuwen’s ice cream shops in New York City. The popular ice cream chain faced backlash when it announced that it would no longer accept cash at its establishments. This decision sparked a debate about the rights of consumers, as cash is considered legal tender and refusing it may be seen as discriminatory towards individuals who rely on cash for various reasons.

“The refusal of cash may disproportionately affect marginalized individuals who may not have access to digital payment methods,” said legal expert Jane Doe. “It raises concerns about financial exclusion and the potential for creating a divide in society.”

The legal challenges surrounding the acceptance of cash also touch upon broader questions about the right of businesses to solely accept digital payments. While businesses have the freedom to choose the payment methods they accept, there is an ongoing debate about whether they should have the right to entirely exclude cash from their transactions. Some argue that this practice can have unintended consequences, such as limiting access to goods and services for those who do not have bank accounts or access to digital payment methods.

| Legal Challenges and the Acceptance of Cash | Implications | Considerations |

|---|---|---|

| Discrimination concerns | Potential financial exclusion | Access to goods and services |

| Regulatory compliance | Privacy and data security | Financial inclusion policies |

| Consumer rights | Legal implications | Equity and social impact |

As the push towards a cashless society continues, it is essential to navigate the legal challenges and carefully consider the implications of refusing cash. Finding a balance between the convenience of digital payment methods and the rights and accessibility of consumers is crucial for creating an inclusive financial system. Ultimately, it is imperative that businesses, lawmakers, and consumers work together to ensure that no one is left behind in a society driven by cashless transactions.

While the benefits of a cashless society are evident, there are costs that need to be considered, including increased prices for consumers and the potential exclusion of vulnerable individuals.

One of the main costs associated with going cashless is the impact on consumer prices. The use of digital payment methods, such as credit cards and mobile payment options, often comes with interchange fees. These fees are typically charged to merchants, who may pass on the costs to consumers through higher prices. As a result, individuals who rely on cashless transactions may find themselves paying more for goods and services.

Another concern is the potential exclusion of certain individuals from the financial system. While digital payment methods offer convenience and efficiency, not everyone has access to them. Vulnerable populations, such as the elderly, low-income individuals, and those without access to smartphones or bank accounts, may find it difficult to participate fully in a cashless society. This exclusion can further exacerbate existing inequalities and perpetuate financial disparities.

The table below illustrates the potential impact of increased prices on essential goods and services:

| Category | Price Increase (%) |

|---|---|

| Groceries | 5-10 |

| Transportation | 3-7 |

| Restaurants | 8-12 |

| Housing | 2-5 |

It is important to carefully consider the costs and consequences of a cashless society. While digital payment methods offer convenience and efficiency, they also come with potential drawbacks. To ensure financial inclusion and mitigate the impact of increased prices, policymakers and businesses need to adopt strategies that address the needs of all members of society.

The Importance of Privacy in a Digital World

As we navigate credit in a cashless society, it is crucial to prioritize privacy and take steps to protect our personal information in the digital age. With the increasing prevalence of digital payment methods and cashless transactions, it is important to be aware of the privacy risks that come with these conveniences.

When using credit cards, mobile payment options, or digital wallets, we expose ourselves to potential privacy breaches. Hackers and identity thieves are constantly seeking ways to gain access to our sensitive data, such as credit card numbers, passwords, and personal information. It is essential to stay vigilant and employ measures to safeguard our privacy.

To protect your personal information, consider the following tips:

- Regularly monitor your credit card and bank statements for any unauthorized transactions.

- Use strong, unique passwords for your online accounts and enable two-factor authentication whenever possible.

- Be cautious when sharing personal information online and only provide it to reputable and secure websites.

- Regularly update your devices and applications to ensure they have the latest security patches.

- Use encryption tools and secure internet connections when making online transactions.

In addition to personal privacy concerns, the shift to a cashless society also raises questions about the management of credit and financial inclusion. While digital payment methods offer convenience, there is a risk that certain individuals may be excluded from the financial system if they do not have access to the necessary technology or banking services.

Moreover, businesses that refuse to accept cash may face legal challenges. The case of Van Leeuwen’s ice cream shops in New York City serves as an example of the potential implications of refusing cash. The decision to solely accept digital payments led to backlash and legal action, as cash remains a legal form of tender.

As we embrace a cashless society, it is crucial to consider the broader implications and potential consequences. We must ensure that digital innovations do not compromise our privacy and financial inclusivity. By prioritizing privacy and implementing necessary safeguards, we can navigate credit in a cashless society while protecting our personal information.

Implications and Consequences of a Cashless Society

A cashless society has far-reaching implications, from credit management to financial inclusivity, and it is essential to weigh these consequences before fully embracing this digital transformation. One of the main benefits of a cashless society is the convenience offered by digital payment methods. With credit cards, mobile payment options like Apple Pay, and peer-to-peer payment apps like Venmo, transactions can be completed quickly and effortlessly. This ease of use has revolutionized the way we make purchases and manage our money.

However, as we navigate credit in a digital world, concerns about privacy and the potential for a credit divide arise. With every digital transaction, personal information is shared, raising concerns about data security and privacy risks. It is crucial for individuals to take proactive measures to protect their personal information and ensure the security of their financial transactions. Financial institutions also play a vital role in safeguarding consumers’ privacy, implementing robust security measures to maintain trust in the digital payment ecosystem.

Another consequence of a cashless society is the potential exclusion of certain individuals from the financial system. While digital payment methods offer convenience, they require access to technology and reliable internet connection. This can create a divide between those who have access to credit and those who do not, potentially exacerbating existing socioeconomic inequalities. It is crucial for policymakers and businesses to consider the inclusivity of digital payment systems and ensure that everyone has equal access to financial services.

Businesses that refuse to accept cash may also face legal challenges. The case of Van Leeuwen’s ice cream shops in New York City serves as an example, where the company faced lawsuits for refusing cash payments. The legal landscape surrounding cashless transactions is still evolving, and businesses must navigate the potential legal implications of solely accepting digital payments. Balancing convenience and inclusivity while respecting legal considerations is crucial for businesses operating in a cashless society.

| Benefits | Concerns | Legal Challenges | Costs |

|---|---|---|---|

| Convenience of digital payment methods | Privacy risks and potential credit divide | Legal implications of refusing cash payments | Increased prices due to interchange fees |

| Effortless transactions | Exclusion of certain individuals from the financial system | Legal landscape surrounding cashless transactions | Potential financial exclusion |

| Improved money management |

Considering the implications and consequences of a cashless society is crucial in shaping the future of credit management and financial inclusion. It is essential to balance the benefits of convenience with the need for privacy and inclusivity. Policymakers, businesses, and individuals must work together to ensure that digital payment systems are secure, accessible, and fair for all.

Conclusion

Navigating credit in a cashless society requires a comprehensive understanding of the benefits, challenges, and strategies to effectively manage your finances in this digital era. As society becomes increasingly cashless, there are both advantages and drawbacks to consider.

One of the key benefits of a cashless society is the convenience offered by digital payment methods. Credit cards, Apple Pay, and Venmo are just a few examples of the tools that have transformed the way we make purchases and manage our money. These digital payment methods provide quick and easy transactions, allowing you to make purchases with just a tap or a swipe. They also offer increased security measures, such as fraud protection and the ability to track your spending in real-time.

However, there are concerns that come with navigating credit in a cashless society. Privacy risks associated with digital transactions are a top concern for many individuals. The potential for personal information to be compromised or shared without consent raises questions about the safety and security of our financial data. Additionally, the shift towards a cashless economy may create a divide between those who have easy access to credit and those who do not, potentially excluding certain individuals from the financial system.

Businesses that refuse to accept cash may also face legal challenges. Recent examples, like the case of Van Leeuwen’s ice cream shops in New York City, have highlighted the potential implications of refusing cash as a form of payment. Ultimately, the question of whether businesses have the right to solely accept digital payments remains a topic of debate.

Furthermore, going cashless can come with its own costs. Interchange fees associated with digital payment methods can lead to increased prices for consumers. The potential exclusion of certain individuals, such as those without access to digital payment tools or those who prefer to use cash, raises concerns about financial equality and inclusivity.

In conclusion, while navigating credit in a cashless society offers convenience and efficiency, it is important to consider the potential consequences and challenges that come with this digital era. By understanding the benefits, addressing privacy concerns, advocating for financial inclusivity, and staying informed about legal implications, you can effectively manage your finances in a cashless economy.

FAQ

Q: What are the benefits of digital payment methods in a cashless society?

A: Digital payment methods such as credit cards, mobile payment options, and digital wallets offer convenience and ease of use. They allow for quick transactions, provide records of purchases, and often offer rewards or cashback programs.

Q: What concerns should I have when navigating credit in a cashless society?

A: Privacy risks are a major concern when it comes to digital transactions. There is also the potential for a divide between those who have access to credit and those who do not. Additionally, some businesses refusing cash as a form of payment may face legal challenges.

Q: Are businesses allowed to refuse cash as a form of payment?

A: While businesses have the right to set their payment policies, there have been legal challenges when refusing cash. For example, Van Leeuwen’s ice cream shops in New York City faced legal action for not accepting cash as a payment method. It is important for businesses to understand the legal implications of going cashless.

Q: What are the costs associated with going cashless?

A: One of the costs of going cashless is the potential increase in prices for consumers due to interchange fees. These fees are charged by credit card companies and can be passed onto the customer. There is also the concern of excluding certain individuals from the financial system if they do not have access to digital payment methods.

Q: How can I protect my privacy in a digital world when managing credit?

A: To protect your privacy, it is important to be cautious when sharing personal information online. Use secure websites and digital wallets, regularly monitor your credit card statements, and be aware of phishing attempts. It is also advisable to review the privacy policies of financial institutions you work with.

Q: What are the broader implications of a cashless society?

A: A cashless society can have implications for credit management and financial inclusion. It is important to consider the potential consequences of excluding certain individuals from the financial system and to ensure that credit remains accessible to all. Additionally, the societal effects of a cashless economy should be carefully considered.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring