Understanding How Local Economies Impact Individual Credit Scores

Understanding the relationship between local economies and individual credit scores is crucial for addressing racial disparities in credit access and wealth inequality. Research has shown that these disparities persist in cities across the economic spectrum, with predominantly nonwhite areas experiencing below-prime median credit scores. This discrepancy not only leads to higher costs for families but also contributes to worsening wealth inequality.

To address this issue, cities can implement various policies and programs. One approach is to assess city debt collection practices, reform city-levied fees and fines, and establish partnerships with financial institutions to provide small-dollar emergency loans. By protecting consumers from unfair business practices and creating financial inclusion programs, cities can support financially vulnerable residents and help improve their credit scores.

Economic conditions also play a significant role in credit scores. Changes in unemployment rates and house price growth can impact an individual’s credit score. During economic expansions, overall credit scores tend to rise, but the relative risk of default between borrowers with different credit scores widens. Lenders should exercise caution when targeting subprime borrowers during expansions, as they may pose a higher risk of default and vulnerability to future economic slowdowns.

Key Takeaways:

- Racial disparities exist in credit scores across different cities and economic spectrums.

- Predominantly nonwhite areas have below-prime median credit scores, leading to higher costs and worsening wealth inequality.

- Cities can address these disparities through policies such as assessing debt collection practices and reforming fees and fines.

- Financial inclusion programs and partnerships with financial institutions can support financially vulnerable residents.

- Economic conditions, including unemployment rates and house price growth, can impact credit scores.

Racial Disparities in Credit Scores and Local Economies

Racial disparities persist in cities across the economic spectrum, with predominantly nonwhite areas experiencing below-prime median credit scores. This inequality in credit access has significant implications for families and contributes to worsening wealth inequality. A study conducted by the Urban Institute found that neighborhoods with higher concentrations of nonwhite residents had lower median credit scores compared to predominantly white neighborhoods. These disparities can result in higher borrowing costs, limited access to affordable housing, and reduced opportunities for wealth accumulation.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →

City policies and financial inclusion programs can play a crucial role in addressing racial disparities in credit scores. By assessing and reforming city debt collection practices, local governments can protect residents from unfair practices that disproportionately affect marginalized communities. Additionally, city-levied fees and fines should be reviewed to ensure they do not impose undue financial burdens on low-income individuals. Establishing partnerships with financial institutions can provide access to small-dollar emergency loans, helping individuals build credit and navigate financial emergencies.

Key Takeaways:

- Racial disparities persist in credit scores across cities, with predominantly nonwhite areas experiencing below-prime median credit scores.

- These disparities contribute to higher borrowing costs, limited access to affordable housing, and worsening wealth inequality.

- City policies, such as assessing debt collection practices and reforming fees and fines, can help address these disparities.

- Partnerships with financial institutions and the implementation of financial inclusion programs can provide support to financially vulnerable residents.

| City | Median Credit Score (Nonwhite Areas) | Median Credit Score (White Areas) |

|---|---|---|

| New York City | 620 | 700 |

| Los Angeles | 590 | 670 |

| Chicago | 580 | 680 |

Racial disparities in credit scores underscore the importance of addressing the systemic barriers that hinder financial access and equality. By implementing policies and programs that promote financial inclusion, cities can help bridge the credit gap and create pathways to economic opportunities for all residents.

Addressing Disparities: City Policies and Financial Inclusion Programs

To address the impact of local economies on personal credit ratings, cities can implement policies such as debt collection practices assessment and establish partnerships with financial institutions, while also creating financial inclusion programs for vulnerable residents. These initiatives can play a crucial role in reducing racial disparities in credit access and promoting greater financial equity.

One key policy that cities can adopt is the assessment of their debt collection practices. By reviewing and reforming the way debts are collected, cities can ensure fair and equitable practices that do not disproportionately burden low-income individuals and communities of color. This can help improve credit scores by reducing the negative impact of past debt on individuals’ financial health.

Another effective strategy is forming partnerships with financial institutions. Collaboration between cities and banks can facilitate access to affordable financial products and services, such as low-interest loans and credit-building programs. These partnerships can provide the necessary support for individuals in improving their credit scores and building a solid financial foundation.

Financial inclusion programs

Financial inclusion programs are instrumental in addressing the vulnerabilities faced by economically disadvantaged residents. Cities can design and implement initiatives that promote financial education, offer affordable banking options, and provide small-dollar emergency loans. These programs help individuals navigate the complex financial landscape, establish positive credit history, and access much-needed funds during financial emergencies.

By combining these strategies, cities can work towards creating a more inclusive and equitable credit landscape. These efforts can mitigate the negative effects of local economic conditions on individual credit scores and promote financial empowerment for all residents.

| Financial Inclusion Programs | Impact |

|---|---|

| Financial Education Programs | Empowers individuals with knowledge and skills to make informed financial decisions, manage debt effectively, and improve credit scores. |

| Affordable Banking Options | Provides access to basic banking services, such as checking and savings accounts, without excessive fees and requirements. |

| Small-Dollar Emergency Loans | Offers immediate financial assistance to individuals facing unexpected expenses or emergencies, reducing the need for predatory lending options. |

Through a holistic approach encompassing policy reforms, partnerships with financial institutions, and financial inclusion programs, cities can make significant strides in addressing the impact of local economies on personal credit ratings. These initiatives have the potential to promote economic equality, reduce wealth disparities, and create a more inclusive financial system that benefits all residents.

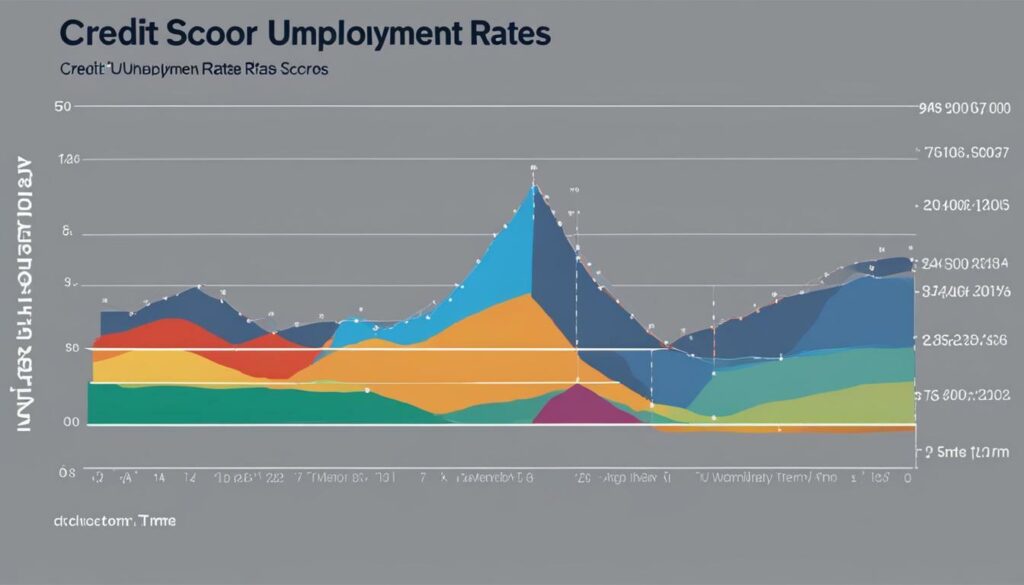

Economic conditions, such as changes in unemployment rates and house price growth, can significantly impact credit scores and the relative risk of default between borrowers. When the economy is thriving and unemployment rates are low, individuals tend to have more stable income and are better able to meet their financial obligations. As a result, credit scores tend to rise during economic expansions.

On the other hand, during economic downturns and high unemployment periods, individuals may struggle to find employment or experience wage cuts, leading to financial instability. This can result in missed payments and defaults on loans, negatively impacting credit scores.

House price growth is another factor that influences credit scores. When the housing market is strong and property values are increasing, homeowners have a greater sense of wealth and financial stability. This can lead to improved credit scores as individuals feel more confident in their ability to repay debts. Conversely, during housing market downturns, falling property values can cause financial strain, leading to lower credit scores.

| Economic Condition | Impact on Credit Scores |

|---|---|

| Economic expansions and low unemployment rates | Rising credit scores |

| Economic downturns and high unemployment rates | Potential decrease in credit scores |

| House price growth | Potential increase in credit scores |

“Understanding how economic conditions can influence credit scores is crucial for individuals and lenders alike. By recognizing the impact of economic fluctuations on creditworthiness, individuals can make informed financial decisions and take appropriate steps to maintain or improve their credit scores. Lenders, on the other hand, can assess the risk associated with borrowers during different economic conditions and adjust their lending practices accordingly.”

It is important to note that economic conditions do not solely determine credit scores. Other factors, such as individual financial behavior and payment history, also play a significant role. However, by understanding the relationship between local economies and credit scores, individuals and lenders can navigate the financial landscape more effectively and mitigate the potential risks associated with economic fluctuations.

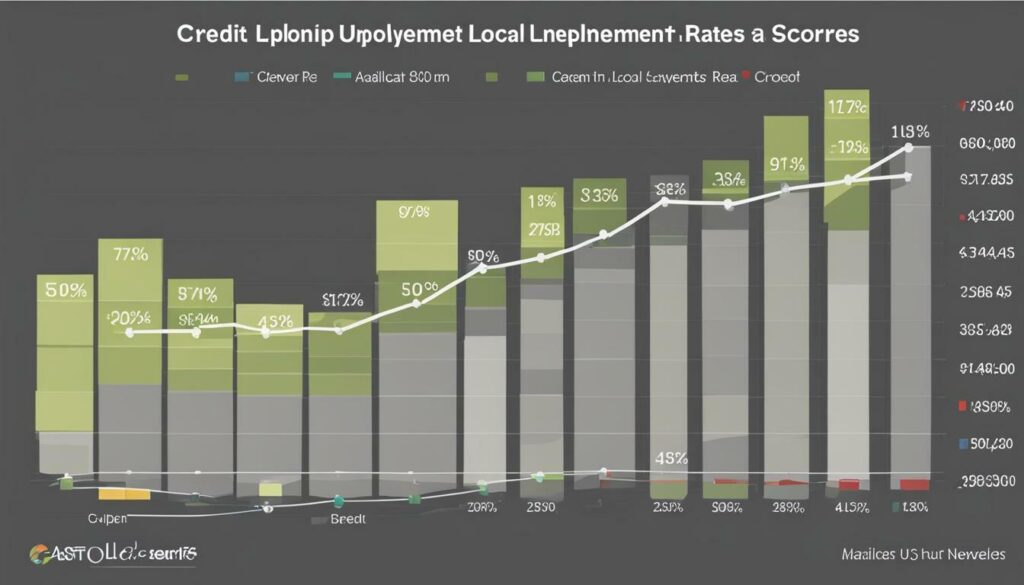

Lenders should exercise caution when targeting subprime borrowers during economic expansions, as they may pose a higher risk of default and vulnerability to future economic slowdowns. The influence of local economic conditions on credit scores is evident in these situations, where borrowers with lower credit scores are more likely to struggle with repayments and face financial instability.

Research shows that economic expansions can lead to an overall increase in credit scores. However, this rise in credit scores is not evenly distributed among all borrowers. Subprime borrowers, who already have lower credit scores, may experience a smaller improvement compared to prime borrowers. This disparity in credit score improvement during expansions highlights the higher risk of default that subprime borrowers face.

Furthermore, targeting subprime borrowers during expansions can expose lenders to a greater risk of default. Economic expansions are often followed by economic slowdowns or recessions, which can lead to job losses and income reductions. Subprime borrowers, who already have limited financial resources, are more vulnerable to economic downturns. Therefore, lenders should carefully evaluate the creditworthiness of subprime borrowers during economic expansions to mitigate the risk of default and potential financial losses.

| Year | Unemployment Rate (%) | House Price Growth (%) |

|---|---|---|

| 2016 | 4.9 | 5.5 |

| 2017 | 4.4 | 6.4 |

| 2018 | 3.9 | 5.0 |

As the table above illustrates, unemployment rates have been decreasing in recent years, accompanied by steady house price growth. While these economic indicators suggest stability and growth, they also contribute to the widening risk of default between borrowers with different credit scores. During economic expansions, borrowers with higher credit scores benefit from increased access to credit and favorable interest rates, while subprime borrowers may face limited options and higher borrowing costs.

In conclusion, understanding the economic influence on credit scores is vital in assessing the risk and vulnerability of borrowers. Lenders should exercise caution when targeting subprime borrowers during economic expansions, taking into account the potential for default and the impact of future economic slowdowns. By considering the local economic conditions and borrower creditworthiness, lenders can make informed decisions that mitigate risk and support financial stability.

In conclusion, it is crucial to recognize the significant influence of local economies on individual credit scores and take appropriate measures to address disparities and promote financial inclusion.

Research shows that racial disparities in credit scores persist across cities, regardless of their economic spectrum. Predominantly nonwhite areas often have below-prime median credit scores, leading to higher costs for families and contributing to worsening wealth inequality.

To address this issue, cities can implement various policies and programs. For instance, assessing city debt collection practices and reforming city-levied fees and fines can help protect consumers from unfair business practices and reduce the financial burden on vulnerable communities. Moreover, establishing partnerships with financial institutions to provide small-dollar emergency loans can offer temporary relief to financially strained individuals.

Economic conditions also play a significant role in credit scores. Changes in unemployment rates and house price growth can impact credit scores, with overall scores rising during economic expansions. However, it is essential for lenders to exercise caution when targeting subprime borrowers during these expansions, as they may pose a higher risk of default and vulnerability to future economic slowdowns.

By understanding the relationship between local economies and individual credit scores, cities can develop strategies to mitigate disparities and promote financial inclusion. It is essential to prioritize policies and programs that support financially vulnerable residents and work towards reducing wealth inequality, ultimately building a more equitable and accessible financial system.

FAQ

Q: How do local economies impact individual credit scores?

A: Local economies can have a significant impact on individual credit scores. Economic conditions such as changes in unemployment rates and house price growth can influence credit scores. During economic expansions, overall credit scores tend to rise, while the relative risk of default between borrowers with different credit scores widens.

Q: Is there a link between local economies and racial disparities in credit scores?

A: Yes, research shows that racial disparities persist in cities across the economic spectrum. Predominantly nonwhite areas often have below-prime median credit scores. This disparity can lead to higher costs for families and contribute to worsening wealth inequality.

Q: What can cities do to address disparities in credit scores caused by local economies?

A: Cities can implement various policies and programs to address disparities in credit scores. These may include assessing city debt collection practices, reforming city-levied fees and fines, and establishing partnerships with financial institutions to provide small-dollar emergency loans. Cities can also protect consumers from unfair business practices and create financial inclusion programs that support financially vulnerable residents.

Q: Why should lenders be cautious when targeting subprime borrowers during economic expansions?

A: Lenders should be cautious when targeting subprime borrowers during economic expansions because these borrowers may pose a higher risk of default and vulnerability to future economic slowdowns. Understanding the potential risks and taking appropriate measures can help prevent further financial hardship for both lenders and borrowers.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring