650 vs 750 Credit Score

The Shocking Difference in Loan Costs For Credit Scores 650 to 750

💡 *A 100-point credit score gap could cost you tens of thousands of dollars over your lifetime. Here’s how.*

One of the fastest ways to boost your score is by optimizing your credit utilization ratio – the amount of available credit you’re using. Experts recommend keeping this under 30%, but for maximum score gains, aim for below 10%. Our comprehensive guide explains exactly how to calculate and improve this crucial scoring factor.

🔍 650 vs. 750 Credit Score: Key Differences

- 650 Score: “Fair” credit. Higher interest rates, fewer loan approvals.

- 750 Score: “Good/Excellent” credit. Lowest rates, best terms.

- Lender Perception: A 750 score signals reliability; 650 means higher risk.

📌 Need context? See What Your Credit Score Really Means.

- 700-739 score: This ‘good’ credit tier qualifies you for most loans at competitive rates

💰 Real-World Cost Comparison

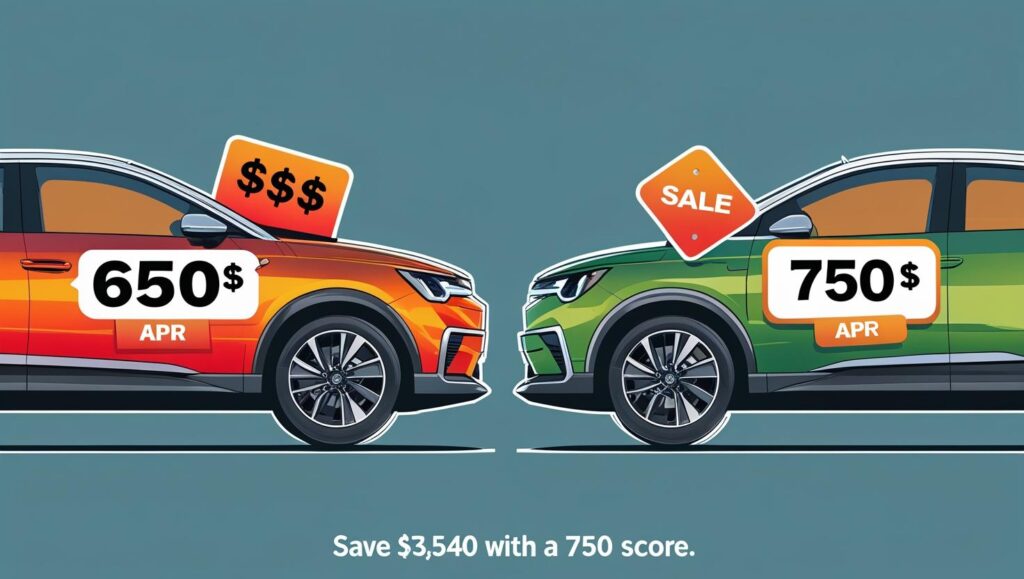

1. Auto Loan (5-Year, $25,000)

- 650 Score: 9% APR → $519/month ($31,140 total).

- 750 Score: 4% APR → $460/month ($27,600 total).

✅ Savings: $3,540 with a 750 score.

2. Mortgage (30-Year, $300,000)

| Credit Score | APR | Monthly Payment | Total Cost |

|---|---|---|---|

| 650 | 9% | $519 | $31,140 |

| 750 | 4% | $460 | $27,600 |

- 650 Score: 5.5% APR → $1,703/month ($613,080 total).

- 750 Score: 4% APR → $1,432/month ($515,520 total).

✅ Savings: $97,560 over the loan term.

📊 Visual breakdown below (see HTML section for table).

💸 Mortgage Costs Over 30 Years

650 Score (5.5% APR): $613,080 total

750 Score (4% APR): $515,520 total

🚀 How to Boost from 650 to 750

- Pay Down Balances (Keep credit utilization under 30%).

- Fix Errors (Dispute inaccuracies on your credit report).

- Avoid Hard Inquiries (Space out loan applications).

- Mix Credit Types (Installment + revolving accounts help).

🔗 Stuck in the 600s? Read 620-659 Credit Score Guide.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →“According to Experian’s 2023 report, borrowers with 750+ scores save an average of 1.5% on mortgage rates versus 650 scores.”

❓ FAQ (Click to Expand)

A 650 score is considered “fair”—not terrible, but lenders see you as higher risk. You’ll qualify for loans, but with higher interest rates than someone with a 750+ score. For context, see our 620-659 credit score guide.

With focused effort (paying down debt, fixing errors, and avoiding new credit checks), you could see improvement in 6–24 months. For a step-by-step plan, check out our credit repair guide.

Likely high credit utilization (using too much of your available credit) or late payments. Reducing balances to <30% of your limit and making on-time payments are the fastest ways to boost your score. Learn more about [alkpt]275[/alkpt].

Not always—lenders also consider income, debt-to-income ratio (DTI), and employment history. But a 750 score ensures you’ll get the lowest rates available. For example, see how 740+ scores maximize savings.

Yes! If you’ve boosted your score from 650 to 750+, refinancing loans (like mortgages or auto loans) could save you thousands. For example, dropping from a 5.5% to 4% APR on a $300k mortgage saves ~$97k over 30 years. Use our credit monitoring tool to track progress.

✅ Bottom Line

A 750 credit score saves thousands vs. 650. Start improving today:

👉 Check Your Credit for Free.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring