Credit Scoring Insights for Millennials and Gen Z Unveiled

Understanding how credit scoring works and implementing effective strategies is vital for millennials and Gen Z to build a strong financial foundation. A recent survey conducted by Experian reveals that many young adults lack the knowledge and resources to successfully navigate credit scoring. As the biggest drivers of spending and the economy, it is crucial that millennials and Gen Z have access to financial education and trusted resources.

In order to improve financial health and optimize credit scores, Experian offers valuable tools and services. These include free credit reports and FICO scores, the option to add positive telecom, utility, and rent payments to credit reports, and a mobile app for establishing and building credit responsibly. Experian also provides credit education resources on their blog and money-saving resources on their website. Additionally, they host #CreditChat on Twitter every Wednesday, where individuals can engage in discussions and gain further insights into credit scoring.

To build and improve credit scores, credit cards can be an effective tool. Even those with limited or poor credit can utilize secured credit cards to demonstrate responsible credit usage and improve their scores. It is important to use credit cards responsibly by paying bills on time and keeping credit utilization low. Other strategies include exploring credit-builder loans and reporting utility bills and rent payments to credit bureaus.

Regularly monitoring credit reports is highly recommended to avoid surprises or errors, and to ensure accuracy. By having a strategy for managing debt, only applying for new credit when necessary and within one’s budget, individuals can work towards maintaining a healthy credit profile.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →Furthermore, open conversations about money are essential for millennials and Gen Z. According to a survey by Forbes Advisor, while the majority of younger generations grew up in families that talked about money, only 41% of baby boomers did. Discussing finances with family and peers provides valuable insights and fosters financial literacy. It is important to overcome hesitations and address the topic of money as early as possible, ensuring that responsibility for teaching financial principles is shared between parents and educators.

Key Takeaways:

- Understanding credit scoring and implementing effective strategies are vital for millennials and Gen Z to build a strong financial foundation.

- Experian offers valuable tools and services such as free credit reports, FICO scores, and the option to add positive payments to credit reports.

- Credit cards can be an effective tool for building credit, when used responsibly.

- Strategies for building credit include exploring credit-builder loans and reporting utility bills and rent payments to credit bureaus.

- Regularly monitoring credit reports is crucial for accuracy and identifying potential errors.

- Open conversations about money with family and peers are important for financial literacy.

- Addressing financial literacy early in life is essential, with responsibility shared between parents and educators.

The Importance of Financial Education for Younger Generations

Many millennials and Gen Z consumers lack the necessary knowledge and resources to navigate credit scoring effectively, making financial education a crucial aspect of their development. A recent survey conducted by Experian revealed that these younger generations struggle with understanding how to build credit successfully. To address this issue, it is essential to provide them with access to reliable financial education and resources.

Experian, a leading credit bureau, offers various tools and services to improve financial health among millennials and Gen Z. They provide free credit reports and FICO scores, allowing individuals to track their creditworthiness. Additionally, Experian offers the option to add positive telecom, utility, and rent payments to credit reports. This enables young adults to showcase their responsible payment behavior and build a positive credit history.

Furthermore, Experian has developed a mobile app that helps establish and build credit responsibly. This app provides valuable guidance on managing finances and offers personalized recommendations for improving credit scores. To supplement their educational resources, Experian hosts #CreditChat on Twitter every Wednesday, where experts provide credit education and answer questions from participants. They also offer a blog with informative articles and money-saving resources on their website.

The Importance of Financial Education for Younger Generations

“Financial education is not only about teaching young adults how to budget or save; it is about empowering them to make informed financial decisions and set themselves up for a successful future.” – Experian

Another effective tool for building credit is the responsible use of credit cards. Even individuals with limited or poor credit can utilize secured credit cards to improve their credit scores. It is crucial to use credit cards responsibly by paying bills on time and keeping credit utilization low. Other options for building credit include credit-builder loans and reporting utility bills and rent payments to credit bureaus.

Managing debt plays a vital role in improving credit scores. It is essential to have a strategy in place and only apply for new credit when necessary and within one’s budget. Regularly monitoring credit reports is also recommended to avoid surprises or errors and ensure accuracy.

A survey conducted by Forbes Advisor revealed that open conversations about money are significantly lacking among families and peers. While the majority of millennials and Gen Zers grew up in families that talked about money, only 41% of baby boomers did. The importance of discussing money openly was emphasized, as these conversations provide valuable financial insights. However, some individuals still feel hesitant to talk about their finances, considering money personal or feeling insecure about their financial situation.

In conclusion, financial education is essential for the younger generations to navigate credit scoring effectively and secure their financial futures. By providing access to trusted resources, such as those offered by Experian, millennials and Gen Z can gain the necessary knowledge to make informed financial decisions. Open conversations about money, both within families and peers, are also crucial for developing a strong foundation in financial literacy. With the right education and resources, younger generations can optimize their credit scores and set themselves up for long-term financial success.

Strategies for Building and Improving Credit Scores

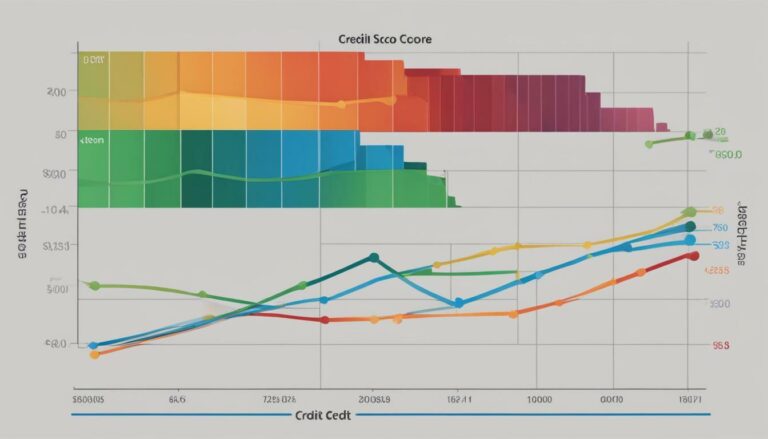

Implementing certain strategies, such as responsible credit card usage and reporting alternative payments, can significantly help millennials and Gen Z improve their credit scores. By understanding these tips and applying them consistently, young adults can set themselves up for financial success in the future.

One effective strategy is to use credit cards responsibly. It is important to make timely payments and keep credit utilization low. By paying off the balance in full each month and keeping credit card balances below 30% of the credit limit, individuals can demonstrate responsible credit management and positively impact their credit scores.

Another strategy to consider is reporting alternative payments. While traditional credit accounts like credit cards and loans are commonly reported to credit bureaus, individuals can also report their utility bills and rent payments. By doing so, they can showcase a positive payment history and potentially boost their credit scores.

| Strategies | Impact on Credit Scores |

|---|---|

| Responsible Credit Card Usage | Can demonstrate responsible credit management and positively impact credit scores. |

| Reporting Alternative Payments | Showcases a positive payment history and potentially boosts credit scores. |

Building credit through credit-builder loans is another valuable option. These loans are specifically designed to help individuals establish or improve their credit scores. By making consistent, on-time payments, borrowers can demonstrate their creditworthiness and build a positive credit history.

It is crucial to have a strategy for managing debt and to only apply for new credit when necessary and within one’s budget. Carefully considering the need for additional credit and maintaining a responsible approach to borrowing can help maintain a healthy credit profile.

Summary:

Implementing strategies such as responsible credit card usage, reporting alternative payments, and utilizing credit-builder loans can significantly improve the credit scores of millennials and Gen Z. By demonstrating responsible credit management and building a positive payment history, young adults can set a strong foundation for their financial future.

Image:

The Importance of Open Conversations about Money

Encouraging open discussions about money and financial literacy among millennials and Gen Z is essential for their long-term financial success. A recent survey conducted by Experian revealed that many young adults lack the necessary knowledge and understanding of credit scoring and personal finance management.

To bridge this knowledge gap, it is important for parents, educators, and trusted resources to provide the younger generations with the tools and information they need to make informed financial decisions. Experian offers free credit reports and FICO scores, as well as resources on their blog and website to help young adults navigate the complexities of credit scoring.

One effective strategy for building credit is utilizing credit cards responsibly. Even individuals with limited or poor credit can benefit from secured credit cards to improve their scores. By paying bills on time and keeping credit utilization low, young adults can gradually build creditworthiness.

Additionally, credit-builder loans and reporting utility bills and rent payments to credit bureaus are other avenues for establishing and improving credit scores. It is crucial for millennials and Gen Z to have a well-rounded strategy for managing debt, applying for credit when necessary and within their budget, and regularly monitoring their credit reports for accuracy.

Table: Strategies for Building and Improving Credit Scores

| Strategies | Description |

|---|---|

| Utilize Credit Cards Responsibly | Paying bills on time, keeping credit utilization low |

| Explore Credit-Builder Loans | Opportunity to establish and improve credit scores |

| Report Utility Bills and Rent Payments | Add positive payment history to credit reports |

Aside from these credit-building strategies, fostering open conversations about money within families and peers is crucial. A survey by Forbes Advisor found that while the majority of millennials and Gen Zers grew up in families that talked about money, only 41% of baby boomers did. By openly discussing financial matters, young adults can gain valuable insights and guidance from those who have experience managing their finances.

It is important to address any hesitations or insecurities about discussing finances, as these conversations can lead to increased financial literacy and empowerment. Encouraging young adults to ask questions, seek advice, and share their own experiences can foster a supportive environment for learning and growth.

By implementing the credit scoring insights and strategies discussed in this article, millennials and Gen Z can set themselves up for a secure and prosperous financial future. A recent survey conducted by Experian revealed that many individuals from these generations lack understanding of how to successfully build credit and are in need of trusted resources for personal finance information.

To address this knowledge gap, it is crucial to provide access to financial education and resources. Experian offers several tools and services to help improve financial health, including free credit reports and FICO scores, the option to add positive telecom, utility, and rent payments to credit reports, and a mobile app for establishing and building credit responsibly. Additionally, Experian hosts #CreditChat on Twitter every Wednesday, offers credit education resources on their blog, and provides money-saving resources on their website.

Building credit can be achieved through various methods such as responsibly using credit cards, utilizing credit-builder loans, and reporting utility bills and rent payments to credit bureaus. It is important to use credit cards wisely by paying bills on time and keeping credit utilization low. Monitoring credit reports regularly is also recommended to avoid surprises or errors and to ensure accuracy.

Moreover, open conversations about money within families and peers play a vital role in financial literacy. While some people may feel hesitant to discuss their finances, addressing the topic of money early in life is crucial. Parents and educators share the responsibility of teaching financial principles to younger generations. The importance of discussing money was emphasized, as open conversations provide valuable financial insights.

By taking advantage of the available credit scoring insights, strategies, and resources, millennials and Gen Z can enhance their financial knowledge and improve their credit scores. This will position them for a promising financial future, enabling them to make informed decisions and achieve their long-term goals.

FAQ

Q: What are some strategies for building and improving credit scores?

A: Some strategies for building and improving credit scores include responsibly using credit cards, utilizing credit-builder loans, and reporting utility bills and rent payments to credit bureaus.

Q: Why is financial education important for younger generations?

A: Financial education is important for younger generations because many Gen Z and millennial consumers lack understanding of how to successfully build credit and manage their finances. Providing trusted resources and education can empower young adults in making informed financial decisions.

Q: How can credit cards be used to build credit?

A: Credit cards can be used to build credit by paying bills on time and keeping credit utilization low. Even those with limited or poor credit can use secured credit cards to improve their scores.

Q: Why are open conversations about money important?

A: Open conversations about money are important because they provide valuable financial insights and help teach financial principles. Discussing money with family and peers can help younger generations develop better financial literacy and make informed decisions.

Q: How often should credit reports be monitored?

A: Credit reports should be monitored regularly to avoid surprises, errors, and to ensure accuracy. It is recommended to check credit reports at least once a year, or more frequently if there are any concerns or changes in financial circumstances.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring