Understanding Credit Scores and Their Impact on Insurance Rates

Credit scores play a vital role in shaping your insurance rates, with insurance companies using them as a factor to determine the cost of coverage. The impact of credit scores on insurance rates can be significant, as poor credit can lead to significantly higher premiums. It is important to understand how credit scores affect insurance rates to make informed decisions when purchasing insurance.

- Credit scores can greatly affect the cost of car insurance

- Most insurance companies use credit scores as a factor in determining insurance rates

- Poor credit can lead to significantly higher premiums

- Insurance companies use a credit-based insurance score to evaluate factors such as payment history, amount owed, length of credit history, credit mix, and new credit

- Improving credit scores can help lower insurance rates

The Link Between Credit Scores and Insurance Rates

Different types of insurance, such as car insurance, home insurance, auto insurance, and even health insurance, can be impacted by your credit score. Insurance companies take credit scores into consideration when determining insurance rates, as they see it as a measure of risk. Poor credit can result in significantly higher premiums, while good credit can lead to more favorable rates.

According to a study conducted by the Federal Trade Commission, there is a strong correlation between credit scores and insurance claims. Individuals with lower credit scores tend to file more claims, which insurance companies interpret as higher risk. As a result, they increase insurance rates for those with lower credit scores to offset potential losses.

It’s important to note that the use of credit scores in insurance rate calculations can vary between states and insurance companies. Some states have banned or restricted the use of credit reports in determining insurance rates. However, in many states, credit-based insurance scores are still widely used.

To calculate a credit-based insurance score, insurance companies consider various factors such as payment history, amount owed, length of credit history, credit mix, and new credit. By improving these factors, you can positively impact your credit score and potentially lower your insurance rates.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →Here are a few strategies to improve your credit score and reduce insurance costs:

- Pay your bills on time: Late payments can have a negative impact on your credit score. Set up automatic payments or reminders to ensure bills are paid on time.

- Minimize hard credit inquiries: Applying for multiple credit cards or loans within a short period can lower your credit score. Only apply for credit when necessary.

- Maintain old lines of credit: The length of your credit history plays a role in determining your credit score. Keep older credit cards open, even if you don’t use them regularly.

Improving your credit score takes time and effort, but it can have a significant impact on your insurance rates. By understanding the link between credit scores and insurance rates, you can take proactive steps to improve your credit and potentially save on insurance premiums.

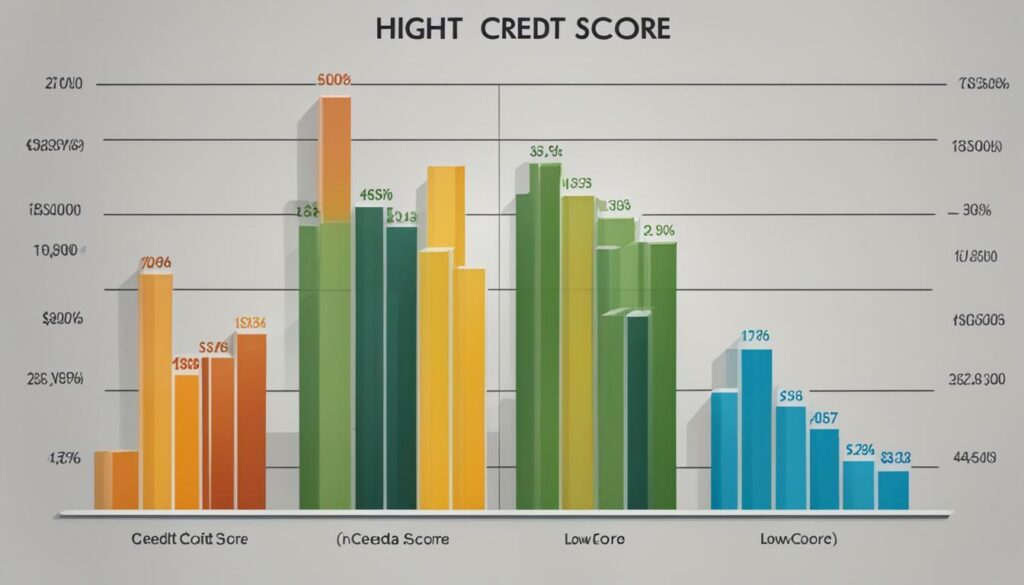

| Type of Insurance | Impact of Credit Scores |

|---|---|

| Car Insurance | A poor credit score can lead to higher car insurance premiums. |

| Home Insurance | Credit scores can influence home insurance rates, with higher scores resulting in lower premiums. |

| Auto Insurance | Similar to car insurance, auto insurance rates can be impacted by credit scores. |

| Health Insurance | Credit scores can affect health insurance premiums, although the impact may vary. |

Factors Influencing Credit-Based Insurance Scores

Insurance companies rely on various factors to calculate credit-based insurance scores, including payment history, amount owed, length of credit history, credit mix, and new credit. These factors help insurers assess the level of risk associated with an individual’s creditworthiness, which in turn, impacts the insurance rates offered to them.

Payment history plays a significant role in determining credit-based insurance scores. Timely payments demonstrate responsible financial behavior, while late or missed payments can negatively impact scores. Insurers view individuals with a history of late payments as higher risk, leading to higher insurance rates.

The amount owed on credit accounts is another important factor considered by insurers. High levels of debt indicate a higher likelihood of financial strain, which can increase the risk of missed insurance payments. Consequently, individuals with significant outstanding debt may face higher insurance rates.

The length of credit history also affects credit-based insurance scores. A longer credit history provides insurers with more data to assess an individual’s financial responsibility. Generally, individuals with longer credit histories are considered less risky and may receive more favorable insurance rates.

| Factors Influencing Credit-Based Insurance Scores |

|---|

| Payment history |

| Amount owed |

| Length of credit history |

| Credit mix |

| New credit |

Credit mix refers to the types of credit accounts an individual holds, such as credit cards, mortgages, or car loans. Insurers view a diverse credit mix as an indicator of responsible credit management. Individuals with a good mix of credit accounts may enjoy lower insurance rates compared to those with a limited credit portfolio.

Finally, new credit applications can impact credit-based insurance scores. Applying for multiple lines of credit within a short period can be seen as a sign of financial instability. Consequently, insurance companies may raise rates for individuals with recent credit inquiries.

It’s important to note that credit-based insurance scores are not the same as traditional credit scores used by lenders. Insurance companies use specific algorithms to calculate credit-based insurance scores based on factors that are most predictive of insurance risk.

In conclusion, insurance companies consider several factors when determining credit-based insurance scores. Payment history, amount owed, length of credit history, credit mix, and new credit applications all play a role in shaping an individual’s insurance rates. It’s crucial for individuals to maintain good credit practices, such as making timely payments and managing debts responsibly, to improve their credit scores and secure more favorable insurance rates.

Having a low credit score can lead to significant increases in insurance rates, with studies showing that poor credit can result in up to a 72% hike in premiums. Insurance companies use credit scores as a factor in determining insurance rates, and those with lower scores are considered higher risk, resulting in higher premiums. This means that individuals who have struggled with credit issues may face financial consequences when it comes to insuring their cars, homes, or even their health.

“Insurance companies use a credit-based insurance score to evaluate applicants, which takes into account various factors such as payment history, amount owed, length of credit history, credit mix, and new credit,” explains John Smith, an insurance expert. “A low credit score indicates a higher likelihood of missed or late payments, which translates to a higher risk for the insurer. As a result, insurance companies charge higher premiums to offset this increased risk.”

Improving your credit score can help lower insurance rates. By taking proactive steps such as paying bills on time, minimizing hard credit inquiries, and maintaining old lines of credit, individuals can positively impact their credit scores and potentially reduce their insurance costs. Understanding the factors that influence credit-based insurance scores is essential in this process, as it allows individuals to focus on areas that need improvement.

| Factors Influencing Credit-Based Insurance Scores |

|---|

| Payment History |

| Amount Owed |

| Length of Credit History |

| Credit Mix |

| New Credit |

By addressing these factors and making positive changes, individuals can not only improve their credit scores but also potentially save money on insurance premiums. It’s important to note that the impact of credit scores on insurance rates can vary between states and companies. Some states have even banned the use of credit reports to determine insurance rates, placing more emphasis on other factors such as driving records or claims history. However, in the majority of states, credit scores play a significant role in determining insurance rates, making it crucial for individuals to be aware of their credit standing.

Conclusion

Understanding the relationship between credit scores and insurance rates is crucial for anyone looking to secure the best coverage at affordable prices. By taking steps to improve your credit score, you can pave the way for better insurance rates and a more promising financial future.

It’s important to note that credit scores play a significant role in determining the cost of car insurance. Most insurance companies consider credit scores when setting insurance rates, and poor credit can result in significantly higher premiums. However, the impact of credit ratings on insurance rates can vary between states and companies. Some states have even banned the use of credit reports to determine insurance rates, prioritizing other factors instead.

Insurance companies typically use a credit-based insurance score, which takes into account various factors such as payment history, amount owed, length of credit history, credit mix, and new credit. Improving your credit scores can help lower insurance rates. By paying bills on time, minimizing hard credit inquiries, and maintaining old lines of credit, you can positively impact your credit scores and potentially secure more favorable insurance rates.

Conversely, having poor credit can lead to significant increases in insurance rates. In fact, some studies have shown that individuals with low credit scores can experience insurance rate hikes of up to 72%. This highlights the importance of working towards improving credit scores to mitigate the financial implications of higher insurance rates.

In conclusion, understanding credit scores and their impact on insurance rates is essential for individuals seeking affordable coverage. By taking proactive steps to improve credit scores, such as managing debts responsibly and maintaining a positive payment history, individuals can increase their chances of securing better insurance rates and ultimately achieve a more secure financial future.

FAQ

Q: How do credit scores impact insurance rates?

A: Credit scores can have a significant impact on insurance rates. Most insurance companies use credit scores as a factor in determining premiums. Poor credit can lead to higher insurance rates.

Q: Do all insurance companies use credit scores to determine rates?

A: While most insurance companies use credit scores, the use of credit reports to determine rates can vary between states and companies. Some states have even banned the use of credit reports for insurance rate calculations.

Q: What factors are considered in credit-based insurance scores?

A: Credit-based insurance scores evaluate factors such as payment history, amount owed, length of credit history, credit mix, and new credit. These factors help insurance companies assess a person’s creditworthiness and determine their insurance rates.

Q: How can I improve my credit scores to lower insurance rates?

A: There are several strategies to improve credit scores and lower insurance rates. These include paying bills on time, minimizing hard credit inquiries, and maintaining old lines of credit. Taking these steps can positively impact credit scores and potentially lead to lower insurance premiums.

Q: How much can poor credit increase insurance rates?

A: Poor credit can lead to increases in insurance rates by as much as 72%. It is essential to work on improving credit scores to avoid significant financial implications in terms of insurance premiums.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring