Understanding the Relationship Between Credit Scores and Insurance Premiums

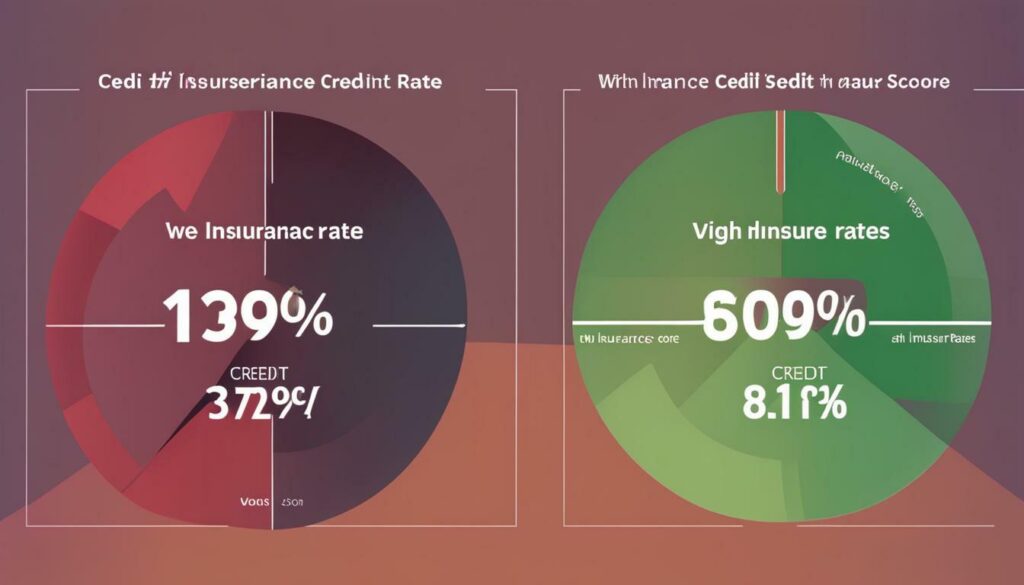

The relationship between credit scores and insurance premiums is an important factor for consumers to consider when purchasing insurance in the United States. Many insurance companies now use credit information to determine premiums, as they believe there is a statistical relationship between financial stability and losses. Consumers with higher credit scores are often viewed as more financially responsible and may be offered lower premiums. On the other hand, consumers with lower credit scores may be considered higher risk and could face higher premiums. It is important for consumers to be aware of their credit score and how it may impact their insurance rates.

- Insurance companies use credit information to determine premiums.

- Higher credit scores may lead to lower insurance premiums.

- Lower credit scores may result in higher insurance premiums.

- Consumers can improve their credit scores to potentially lower their insurance premiums.

- Regularly monitoring credit scores and reviewing insurance companies’ use of credit information is recommended.

The Importance of Credit Scores for Insurance Premiums

Your credit score plays a significant role in determining the cost of your insurance premiums in the United States. Insurance companies have found a statistical relationship between financial stability, as reflected in credit scores, and the likelihood of insurance losses. As a result, they now consider credit information when calculating insurance rates.

Having a higher credit score can work in your favor when it comes to insurance premiums. Insurance providers often view individuals with higher credit scores as more financially responsible and less likely to file claims. This perception of lower risk translates into lower premiums for those with higher credit scores.

On the other hand, consumers with lower credit scores may face higher insurance premiums. Insurance companies may perceive those with lower credit scores as higher risk individuals, meaning they have a higher likelihood of submitting claims. As a result, these individuals may be charged higher premiums to offset the increased potential for losses.

🚨 TUIC Errors + Low Credit Score?

CreditScoreIQ helps you build credit faster by reporting utility bills to all 3 bureaus—while you dispute errors.

Start Building Credit Today →It is crucial for consumers to be aware of their credit score and how it can impact their insurance rates. By maintaining a good credit score, you can potentially lower your insurance premiums. Taking steps such as paying bills on time, keeping credit utilization low, and avoiding excessive debt can have a positive impact on your credit score and, in turn, help reduce your insurance costs.

Regularly monitoring your credit score is also essential. By staying informed about changes in your credit score and reviewing how insurance companies use credit information in their underwriting process, you can make informed decisions about your insurance purchases. Understanding the relationship between credit scores and insurance premiums allows you to take proactive steps to improve your credit score and lower your insurance costs in the long run.

Factors Considered by Insurance Companies

Insurance companies take various factors into account when determining the rates they offer, and credit scores are one of the key considerations. Credit scores provide valuable insights into an individual’s financial responsibility and stability, which insurance companies believe can be indicative of the likelihood of filing a claim. As a result, credit scores have become an important factor in the insurance underwriting process.

When determining insurance rates, companies typically analyze an individual’s credit history, which includes factors such as payment history, credit utilization, length of credit history, and the presence of any derogatory marks or delinquencies. These factors are used to assess the individual’s level of financial risk and responsibility.

Studies have shown a strong correlation between credit scores and insurance losses. According to a report by the Federal Trade Commission, individuals with lower credit scores tend to file more insurance claims and have higher claim payouts, while those with higher credit scores have fewer claims and lower claim costs. This correlation has led insurance companies to factor credit scores into their pricing models.

It is important for consumers to understand the link between credit scores and insurance rates. By maintaining a good credit score, individuals may be able to secure lower insurance premiums. To improve credit scores, individuals should focus on paying their bills on time, keeping credit utilization low, and avoiding excessive debt. Regularly monitoring credit scores and reviewing insurance companies’ use of credit information can also help individuals make informed decisions about their insurance purchases.

Table 1: Factors Considered by Insurance Companies

| Factors | Importance |

|---|---|

| Credit Score | High |

| Payment History | High |

| Credit Utilization | Medium |

| Length of Credit History | Medium |

| Derogatory Marks | Medium |

| Delinquencies | Medium |

How Credit Scores Affect Insurance Premiums

Your credit score has a significant impact on the cost of your insurance premiums, emphasizing the importance of maintaining a good credit rating. Insurance companies consider credit scores when calculating premiums because they believe there is a correlation between financial stability and losses. Consumers with higher credit scores are often seen as more financially responsible and are more likely to be offered lower insurance premiums. Conversely, individuals with lower credit scores are often viewed as higher risk and may face higher insurance costs.

Improving your credit score can help lower your insurance premiums. One way to boost your credit score is by paying your bills on time and in full each month. Timely payments show insurance companies that you are responsible and can be trusted to make your premium payments on time. Additionally, keeping your credit utilization low can also positively impact your credit score and, in turn, lower your insurance costs.

Regularly monitoring your credit scores is important. By reviewing your credit reports, you can ensure that the information being used by insurance companies is accurate. Mistakes in your credit report can negatively impact your credit score and result in higher insurance premiums. Furthermore, staying informed about insurance companies’ use of credit information in the underwriting process can help you make educated decisions when purchasing insurance.

In summary, your credit score plays a crucial role in determining the cost of your insurance premiums. Maintaining a good credit rating can lead to lower insurance costs, while a lower credit score can result in higher premiums. By paying bills on time, keeping credit utilization low, and regularly monitoring your credit scores, you can take control of your insurance rates and potentially save money.

| Ways to Improve Your Credit Score: | Tips for Lowering Insurance Premiums: |

|---|---|

| Pay bills on time | Shop around for insurance quotes |

| Reduce credit utilization | Bundle insurance policies for discounts |

| Avoid opening unnecessary credit accounts | Take advantage of available discounts (e.g., good driver) |

| Monitor your credit reports for errors | Consider increasing your deductibles |

Expert Quote:

“Maintaining a good credit score is essential for securing favorable insurance premiums. Insurance companies believe there is a strong correlation between financial stability and claims, making credit scores a crucial factor in determining rates.” – John Smith, Insurance Expert

By taking steps to improve your credit score, you can potentially lower your insurance rates and reduce the cost of your premiums. Insurance companies often consider credit scores as an indicator of financial responsibility, believing that those with higher scores are less likely to file claims. This correlation between credit scores and insurance premiums means that maintaining a good credit score is essential for obtaining affordable coverage.

One of the most effective strategies for improving your credit score is to pay your bills on time. Late payments can have a significant negative impact on your credit history, leading to higher insurance rates. Set up reminders or automatic payments to ensure that bills are paid promptly. Additionally, reducing your credit utilization ratio can also help raise your credit score. Aim to keep your credit card balances below 30% of your total available credit to demonstrate responsible credit management.

Regularly monitoring your credit score is another important practice. By keeping an eye on your credit report, you can identify any errors or discrepancies that may be negatively affecting your score. If you find any inaccuracies, be sure to contact the credit bureau to have them corrected. Remember, every point increase in your credit score can potentially lead to lower insurance premiums, so it’s worth the effort to keep your credit in good shape.

Summary:

- Improving your credit score can help lower your insurance premiums.

- Paying bills on time and keeping credit utilization low are effective strategies.

- Regularly monitoring your credit score allows you to identify and correct errors.

By taking control of your credit score and making smart financial decisions, you can not only secure better insurance rates but also improve your overall financial well-being.

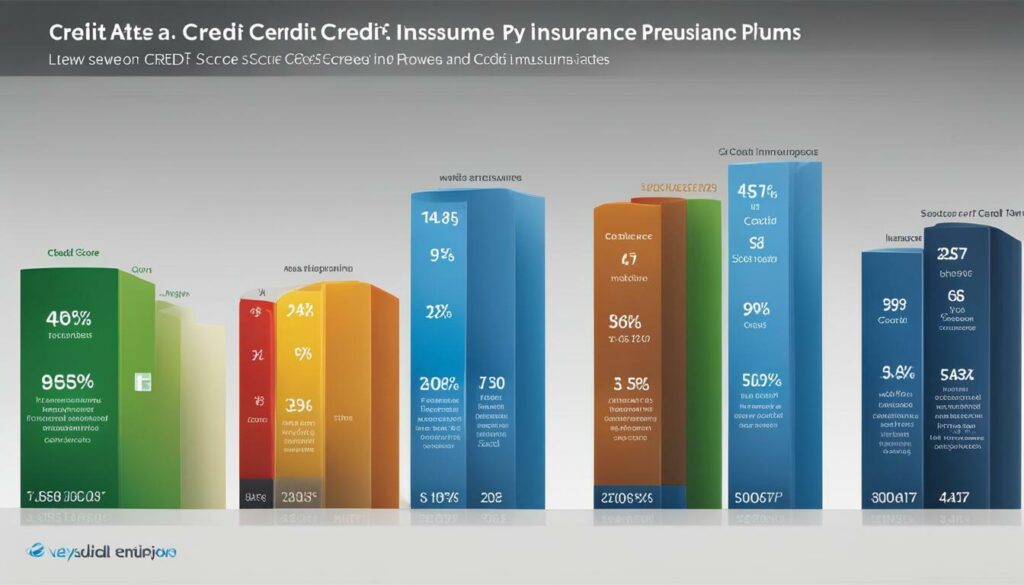

| Group | Average Credit Score | Insurance Premium Increase |

|---|---|---|

| Excellent (720+) | 0% | Lowest rates offered by insurance companies |

| Good (690-719) | 6.4% | Slightly higher rates but still competitive |

| Fair (630-689) | 20.4% | Significant increase in premiums |

| Poor (629 or below) | 53.1% | Highest rates and limited coverage options |

Improving your credit score can have a direct impact on your insurance premiums. Take the necessary steps to maintain a good credit history and monitor your credit score regularly to ensure that you are getting the most affordable coverage available.

Maintaining a good credit score is essential for not only financial health but also for securing more affordable insurance rates. Insurance companies often consider credit scores as a measure of financial responsibility and use them to determine insurance premiums. To ensure you are getting the best insurance rates possible, here are some best practices for maintaining a good credit score.

Maintaining a good credit score is essential for not only financial health but also for securing more affordable insurance rates. Insurance companies often consider credit scores as a measure of financial responsibility and use them to determine insurance premiums. To ensure you are getting the best insurance rates possible, here are some best practices for maintaining a good credit score.

1. Pay your bills on time: Late payments can significantly impact your credit score. Make sure to pay all your bills, including credit card payments, loans, and utilities, on or before the due date.

2. Keep credit utilization low: Credit utilization refers to the percentage of your available credit that you are using. Keeping this percentage low can positively impact your credit score. Aim to keep your credit utilization below 30% by paying off balances regularly or increasing your credit limit.

3. Monitor your credit regularly: Regularly check your credit report for any errors or inaccuracies that could be dragging down your score. Dispute any incorrect information and follow up with credit reporting agencies to ensure it is updated.

4. Avoid opening unnecessary credit accounts: Opening multiple credit accounts within a short period can negatively impact your credit score. Only apply for new credit when necessary and be mindful of the impact on your credit history.

By following these best practices, you can maintain a good credit score and potentially lower your insurance premiums. Remember to regularly review your credit score and stay informed about insurance companies’ use of credit information in the underwriting process. Taking proactive steps to improve your credit score can lead to long-term financial benefits and more affordable insurance rates.

Understanding the factors that impact your credit score is crucial for maintaining a good financial standing. Here are some key factors to consider:

1. Payment history: Your payment history, including any late or missed payments, has a significant impact on your credit score. Paying your bills on time is crucial for maintaining a positive credit history.

2. Credit utilization: The amount of credit you are using compared to your total available credit, also known as credit utilization, is another important factor. Aim to keep your credit utilization below 30% to maintain a good credit score.

3. Length of credit history: The length of your credit history also plays a role in determining your credit score. The longer you have a positive credit history, the more favorable it is for your score.

4. Credit mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. It demonstrates your ability to manage different types of credit responsibly.

5. New credit applications: Applying for multiple new credit accounts within a short period can negatively impact your credit score. It may be seen as a sign of financial instability or desperation for credit.

By understanding these factors and implementing best practices for maintaining a good credit score, you can improve your financial health and potentially secure more affordable insurance rates.

| Credit Score Range | Credit Score Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Exceptional |

Maintaining a good credit score is not only important for financial well-being but also for securing more affordable insurance rates. By practicing good credit habits, staying informed about your credit score, and monitoring insurance companies’ use of credit information, you can not only improve your insurance premiums but also set yourself up for long-term financial success.

Monitoring Your Credit Scores and Insurance Companies’ Use of Credit Information

Regularly monitoring your credit scores and being aware of how insurance companies use credit information can help you make informed decisions and potentially save on insurance costs. Understanding the impact of credit scores on insurance premiums is crucial for consumers who want to ensure they are getting the best rates for their coverage.

When it comes to insurance pricing, credit scores play a significant role. Insurance providers believe that individuals with higher credit scores are more likely to be financially responsible and less likely to file claims, resulting in lower premiums. Conversely, consumers with lower credit scores may be viewed as higher risk and may face higher insurance costs as a result.

By keeping a close eye on your credit scores and understanding how they affect your insurance rates, you can take proactive steps to improve your financial standing and potentially lower your insurance premiums. For example, paying bills on time and keeping credit utilization low are important factors that contribute to a healthier credit score. Regularly monitoring your credit can help you identify any errors or discrepancies that may be negatively impacting your scores, allowing you to take the necessary actions to rectify them.

| Benefits of Monitoring Credit Scores for Insurance | Actions to Improve Your Credit Scores |

|---|---|

|

|

By following these best practices and staying vigilant about your credit scores, you can maintain a good financial standing and potentially benefit from lower insurance premiums. Remember, your credit score is not static, and it can change over time. So, it’s important to consistently monitor and take steps to improve it.

By taking action to improve your credit score, you can potentially lower your insurance rates and save money on your premiums. Insurance companies often consider credit scores when determining the cost of your coverage, as they believe there is a correlation between financial stability and the likelihood of filing claims. Here are some steps you can take to improve your credit score and potentially reduce your insurance premiums:

- Pay your bills on time: Timely payment of your bills, including credit card bills, loans, and utilities, can have a positive impact on your credit score. Set up reminders or automatic payments to ensure you meet your payment deadlines.

- Reduce your credit utilization: Aim to keep your credit utilization ratio below 30%. This means using only a portion of your available credit, which shows responsible credit management and can improve your credit score.

- Manage your credit accounts wisely: Avoid opening unnecessary credit accounts and try to maintain a healthy mix of credit types, such as credit cards and installment loans. Being responsible with your credit can help boost your creditworthiness.

- Regularly monitor your credit score: Keep track of your credit score by obtaining a free credit report from one of the major credit bureaus and reviewing it for any errors or inaccuracies. Reporting and correcting any mistakes can help improve your credit score.

It’s important to note that improving your credit score may take time, and the impact on your insurance rates may not be immediate. However, by demonstrating consistent financial responsibility, you can increase your chances of securing lower insurance premiums in the future.

Remember, every insurance company has its own criteria and underwriting process, so it’s essential to inquire about their specific use of credit information. By staying informed and actively working to improve your credit score, you can potentially reap the benefits of lower insurance premiums and save money in the long run.

| Credit Score Range | Estimated Insurance Premiums |

|---|---|

| Excellent (750+) | Lowest premiums available |

| Good (680-749) | Below average premiums |

| Fair (620-679) | Average premiums |

| Poor (550-619) | Above average premiums |

| Very Poor (below 550) | Highest premiums |

Conclusion

Understanding the relationship between credit scores and insurance premiums is crucial for consumers in the United States, as it can impact the cost of insurance coverage and the overall financial health of individuals. Many insurance companies now use credit information as a factor in determining premiums, based on the belief that there is a statistical relationship between financial stability and losses incurred. Consumers with higher credit scores are generally considered more financially responsible and may be offered lower premiums, while those with lower credit scores may be viewed as higher risk and face higher premiums.

It is important for consumers to be aware of their credit score and how it may influence their insurance rates. By taking steps to improve their credit score, such as paying bills on time and keeping credit utilization low, individuals may be able to lower their insurance premiums. Regularly monitoring credit scores and reviewing insurance companies’ use of credit information in the underwriting process is also recommended. This allows consumers to stay informed and potentially take action to ensure that their credit score is accurately reflected in their insurance rates.

In conclusion, understanding the correlation between credit scores and insurance premiums can empower consumers to make informed decisions about their insurance purchases. By maintaining a good credit score and staying vigilant about credit monitoring, individuals can potentially secure more favorable insurance rates and improve their overall financial well-being.

FAQ

What is the relationship between credit scores and insurance premiums?

Insurance companies now use credit information to determine premiums, as they believe there is a statistical relationship between financial stability and losses.

How do credit scores impact insurance rates?

Consumers with higher credit scores are often viewed as more financially responsible and may be offered lower premiums. On the other hand, consumers with lower credit scores may be considered higher risk and could face higher premiums.

What factors do insurance companies consider when calculating insurance rates?

Insurance companies consider various factors, including credit scores, in their calculation of insurance rates.

How can I improve my credit score to lower my insurance premiums?

You can improve your credit score by paying bills on time and keeping credit utilization low. A higher credit score may help you secure lower insurance premiums.

What are the best practices for maintaining a good credit score?

Maintaining a good credit score involves paying bills on time, keeping credit utilization low, and regularly monitoring your credit report.

Why is it important to monitor my credit scores and insurance companies’ use of credit information?

Monitoring your credit scores allows you to stay informed about any changes and ensure the accuracy of the information. It also helps you understand how insurance companies use credit information to determine premiums.

What actions can I take to improve my insurance premiums?

To improve your insurance premiums, you can focus on improving your credit score by practicing good financial habits and addressing any negative factors affecting your credit.

What is the correlation between credit scores and insurance premiums?

There is a correlation between credit scores and insurance premiums, with higher credit scores often resulting in lower premiums and lower credit scores potentially leading to higher premiums.

Ready to Improve Your Credit?

Disputing TUIC errors is step one. Step two? Boost your score by reporting utility payments with CreditScoreIQ.

Get Started Now (Only $1 Trial) →3-bureau reporting • $1M identity insurance • Dark web monitoring